Blog • December 17, 2025 - Valentin Rousseau

This article introduces a multi-part series examining the structural and financial role of debt using public Bitcoin mining operations as a proxy for the broader mining ecosystem. Capturing debt dynamics in a mining operation is vital when considering using leverage to either start or scale a mining business.

Through an analysis of leverage levels and capital structure dynamics, this first article will provide a foundational overview of how debt instruments are deployed across the sector. From explaining the type of debt instruments previously used by miners and how actors adapted their use of leverage to changing market conditions.

Subsequent articles will explore the historical pricing of interest rates within the mining sector, including sensitivity analyses on leverage ratios and borrowing costs, shedding light on their influence over financial sustainability and operational scalability.

The final segment of this series will focus on convertible notes - a hybrid financing mechanism at the intersection of debt and equity - highlighting their growing relevance in miners’ capital-raising strategies.

The loan is the most popular debt instrument used by miners. It is almost always secured by an asset (infrastructure, machines, BTC, or hashrate) which can be seized by the lender in case of default. At issuance. It is usually a long-term liability, implying a maturity of at least 366 days.

Depending on the terms, a loan will involve monthly or quarterly payment of interest and a portion of the principal (the original amount borrowed). A balloon payment is when a large portion of the principal is paid at maturity.

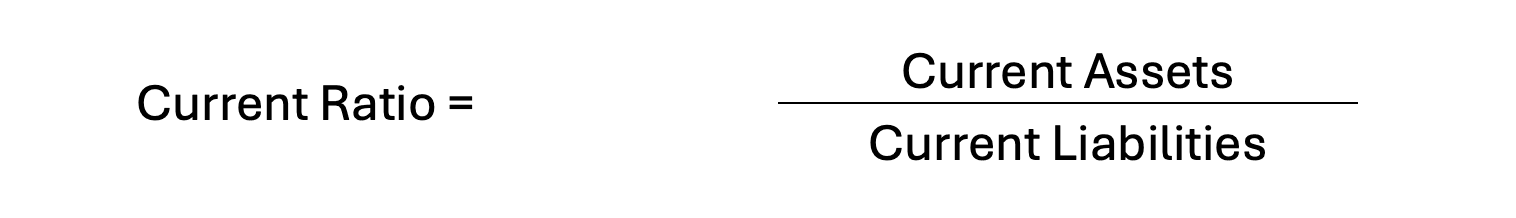

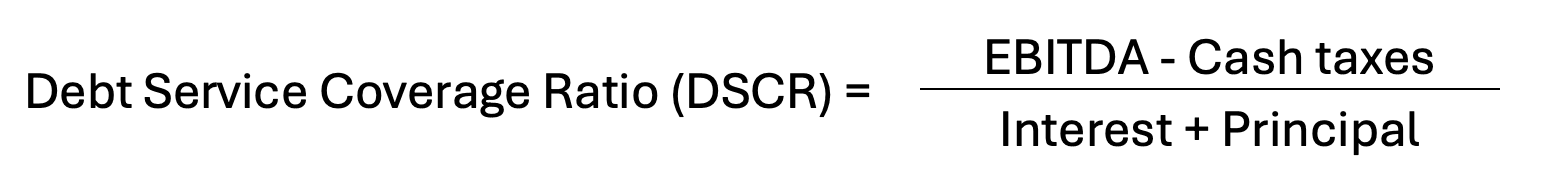

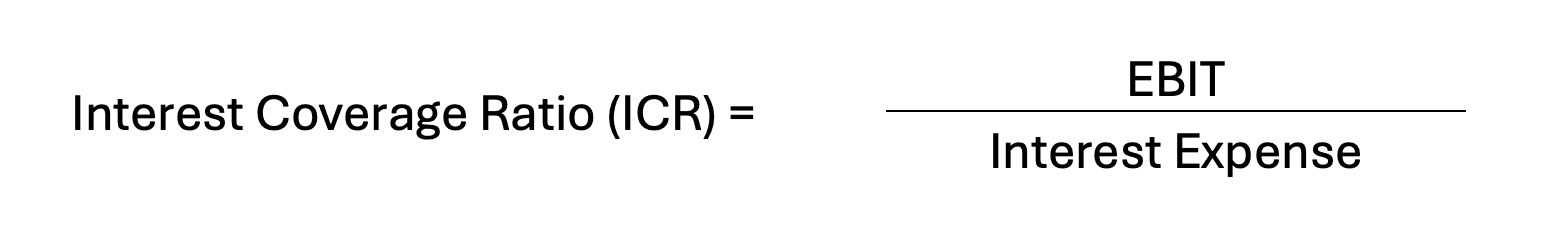

To mitigate its risk, the lender might set some covenants, which are conditions the borrower must obey. Typically, a borrower must abide by certain financial ratios such as a debt service coverage ratio (DSCR), interest coverage ratio (ICR) or the current ratio (CR). Those ratios either evaluate the miner’s capacity to refund its loan given the level of leverage supported and the liquidity on hand to cover short-term debt.

As we will investigate in an upcoming article in this series, interest rates depend on the volume of debt contracted, the duration, as well as the collateral securing the debt. The credit score may also play a role in assessing the interest rate.

Perceived as a risky business, miners don’t have access to conventional bank loans but instead rely more on financial institutions, exchanges or brokers. These lenders charge relatively high interest rates. To name a few: NYDIG, Galaxy, Liberty Commercial, Trinity Capital, Marquee partners, Western Alliance, and Coinbase.

In recent years, the mining sector has seen increased utilization of credit facilities—structured lending vehicles that provide greater operational flexibility than standard term loans. While also long-term in nature, credit facilities permit borrowers to draw, repay, and re-draw funds up to a specified credit limit during the term of the agreement. This feature reduces the administrative burden of reapplying for new capital and supports variable liquidity needs.

Credit facilities often incorporate covenants, maintenance fees, withdrawal charges, and other fee layers that must be carefully assessed. These instruments are particularly well-suited to firms managing large capital outflows, equipment purchases, or energy-related expenditures with uncertain timing.

Corporate bonds represent another long-term funding avenue for miners, offering maturities typically ranging from one to ten years, with five-year tenors being most common. These instruments may carry fixed or floating interest rates, with interest payments disbursed quarterly or annually. Unlike in loans, principal repayment is deferred until maturity, which can improve short-term cash flow but increase long-term liability exposure.

Issuing a bond allows miners to access a broader investor base and can be more cost-effective at scale, though it typically requires more regulatory compliance and investor reporting.

Convertible notes occupy a hybrid space between debt and equity financing. These instruments grant lenders the option to convert their debt into equity shares of the issuing company, usually at a predetermined price or with a discount applied to future valuations. Until conversion, holders earn interest on the note, maintaining downside protection while retaining participation in the equity upside.

In the mining sector, convertible notes have recently become an increasingly popular tool for bridging liquidity needs while limiting immediate equity dilution. Their strategic importance will be explored more thoroughly in a dedicated section of this series.

Historically, mining operations have mostly relied on equity as their prime financing method. However, to reach a certain scale and boost their growth, miners started collateralizing certain assets. ASICs became the first asset to be collateralized, while BTC-backed loans have become more popular recently.

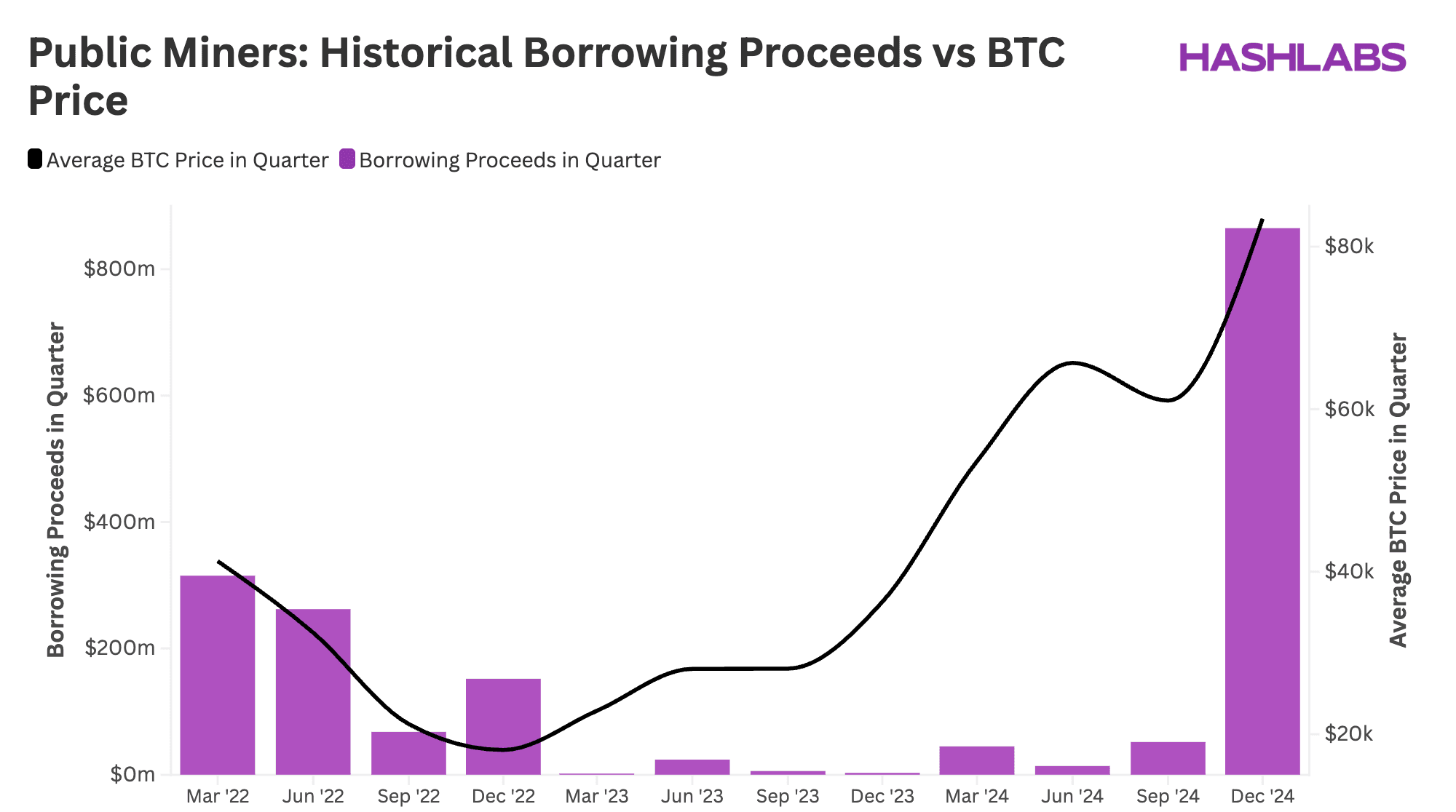

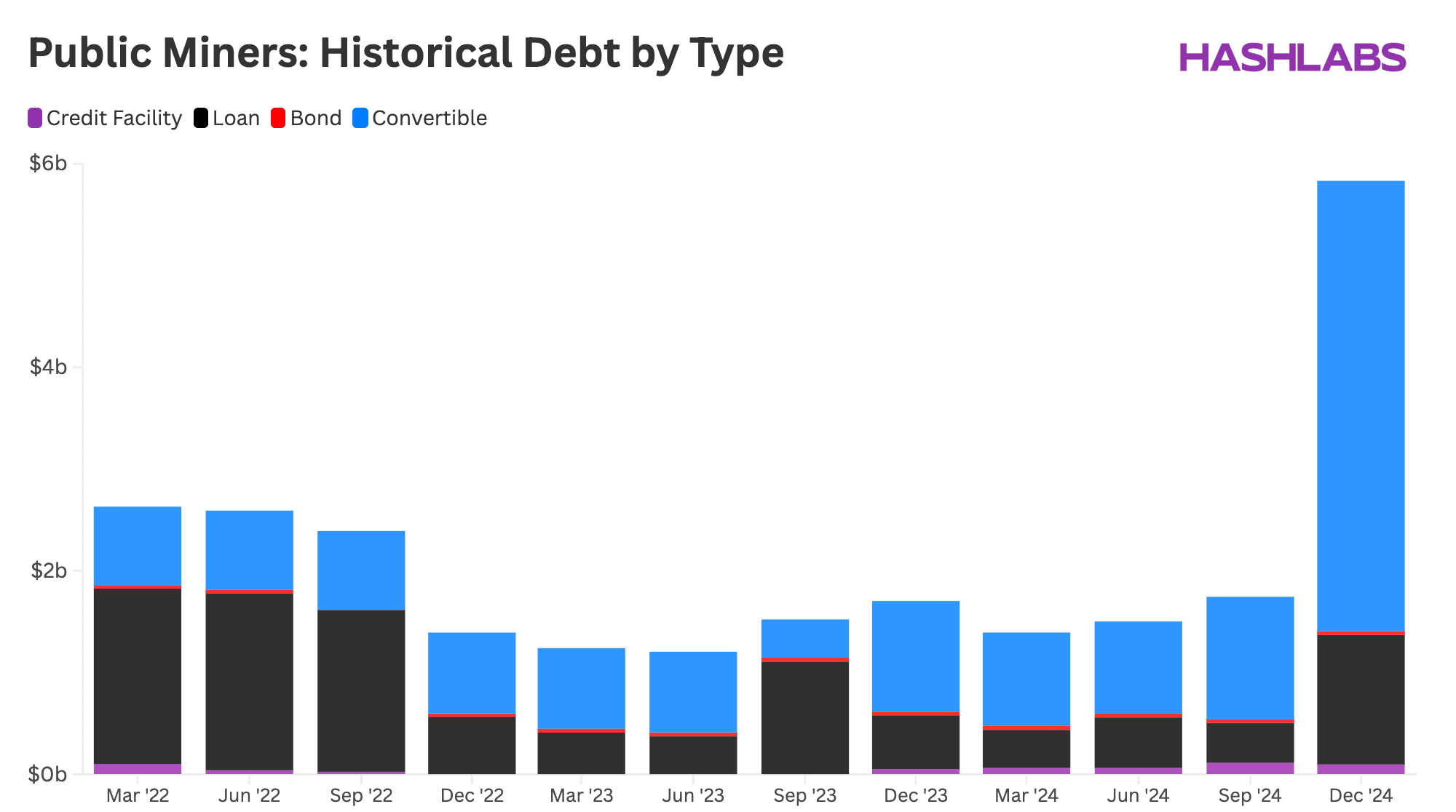

However, to accelerate scale while mitigating dilution, miners progressively turned to debt instruments, initially leveraging their fleets of ASICs as collateral. ASIC-backed loans emerged as the first widely adopted form of secured debt, whereas BTC-backed loans will take more time to enter the market. The 2021–2022 period marked a shift in capital strategy: following a wave of IPOs and secondary offerings, debt financing became an attractive, anti-dilutive alternative. By H1-22, public mining companies had collectively borrowed $537M, primarily through asset-backed lending structures.

In stark contrast, the post-crash deleveraging period from Sep-22 to Sep-24 saw a dramatic reduction in new debt issuance, with only $350M in additional borrowing over two years—reflecting the broader bear market sentiment and constrained liquidity. The market downturn in Q3-22, triggered by macro tightening and amplified by crypto-specific failures (e.g., Terra-Luna, Celsius, and ultimately FTX), exposed the structural fragility of miners overexposed to debt. At the other end of the spectrum, public peers accumulated approximately $865M from borrowings (excluding convertibles) in Dec-24 capitalizing on improved market economics.

Trapped under mountains of debt, most miners were not able to resist the market crash that occurred in the second half of 2022. TeraLuna was the first domino to fall, before Celsius and FTX eventually collapsed.

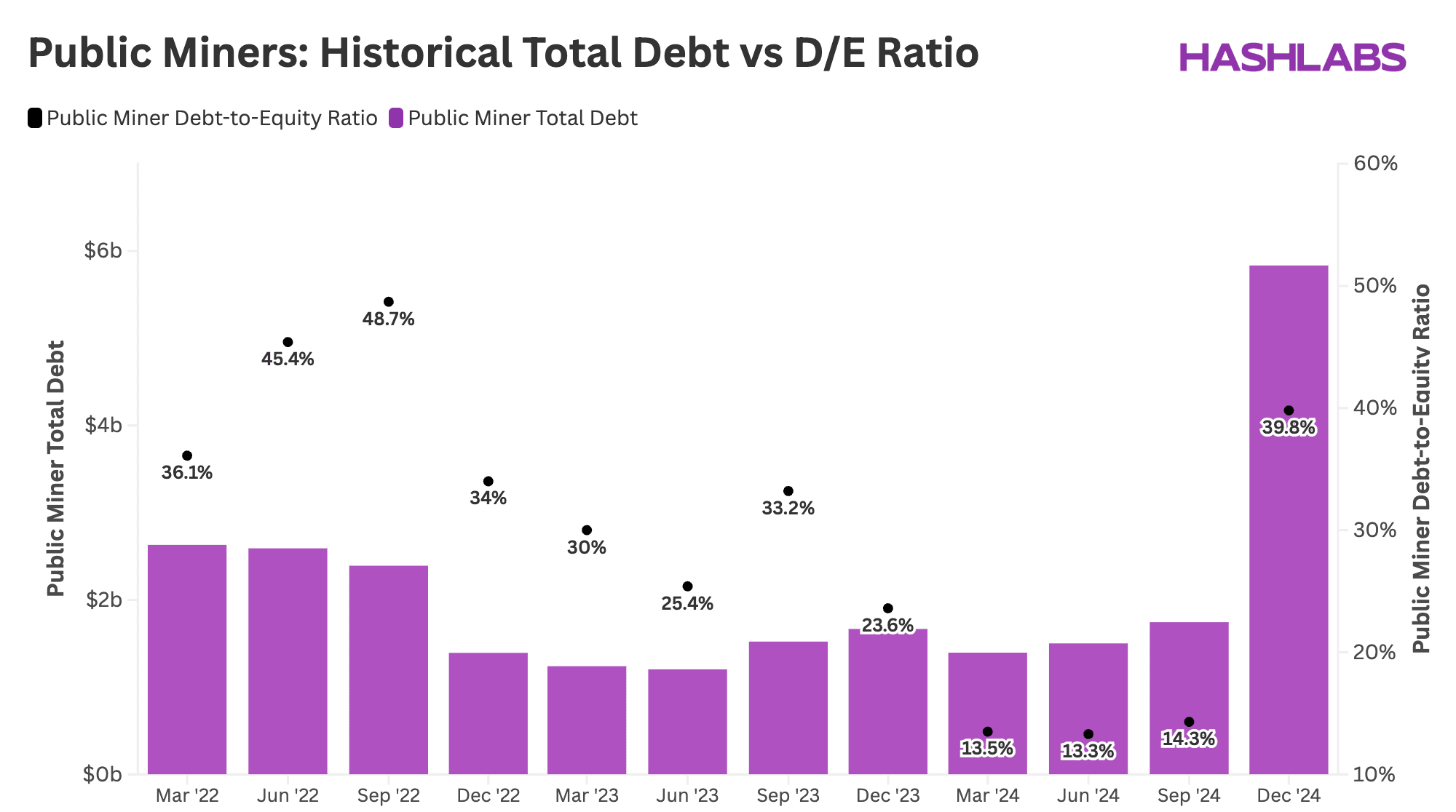

The fallout was swift. Miners began a sector-wide deleveraging process as early as June 2022, reducing debt balances by 86% in just six months. The industry’s Debt-to-Equity ratio, which peaked at 49.5% in September 2022, subsequently declined to only 13.3% by June 2024—its lowest point in the observed period. Crunched for capital, several mining firm defaulted on loans, surrendering collateral—typically ASIC machines—to satisfy obligations or renegotiate terms.

In total, Galaxy research estimated that Pubcos defaulted on 11.59 EH of machines. Delving into the most important failures, Stronghold and IREN respectively defaulted on $67M and $108M of debt to NYDIG representing 6.1EH. Furthermore, Core Scientific and Compute North filed for bankruptcy in late 2022. Another notable example is the sale of Helios operated by Argo, to Galaxy (its lender). This data center that now is the epicenter of the HPC pivot as the financial company signed a deal with CoreWeave to host next-generation GPUs.

Facing rising borrowing costs and falling ASICs prices, the nightmare scenario occurred for miners highlighting their reliance and the significance of conducting stress-tests on operations.

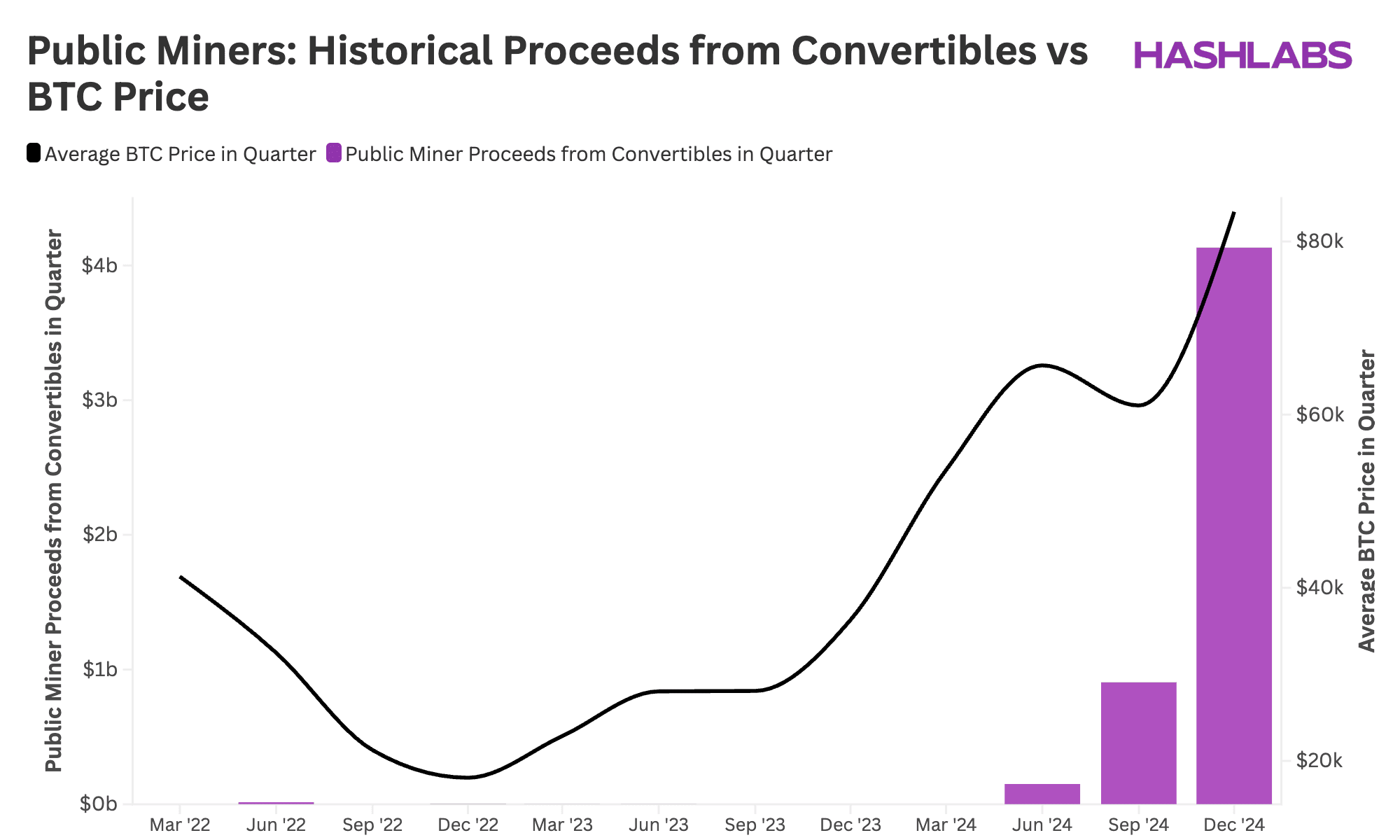

Conversely, the 2024 bull cycle, catalyzed in part by favorable U.S. political developments and Bitcoin ETF approvals, reinvigorated investor sentiment. As equity valuations rebounded, miners turned to more sophisticated financing vehicles, notably convertible notes, to secure capital while minimizing immediate dilution. In H2-24 alone, miners raised over $5 billion through convertible debt instruments—a subject that will be explored in depth in a forthcoming article.

The evolution of miners’ capital structure can also be observed through a breakdown of debt volumes by instrument type. In line with the sharp resurgence of convertible notes, total debt levels increased by 234% from Q3-24 to Q4-24, with convertibles accounting for approximately 70% of all the total debt volume as of Q4-24. This shift highlights a broader strategic pivot toward hybrid financing mechanisms that offer capital access while minimizing immediate equity dilution.

Debt remains a powerful lever for operational scale, yet careful attention must be paid to the underlying terms and risk parameters—a focus that will be further developed in the second installment of this series. The experience of the 2022 deleveraging cycle underscores the importance of prudent leverage strategies, particularly in volatile, asset-dependent industries like Bitcoin mining.

Since that period, ASIC-backed loans have largely receded, giving way to Bitcoin-backed lending, which offers greater flexibility and price transparency for borrowers, especially in a rising market environment where Bitcoin serves as a liquid and appreciating collateral. Meanwhile, hashrate-backed financing—which involves pledging future mining output as security—continues to exist as a niche product, though often at a premium cost compared to more conventional collateral structures. These developments signal a broader evolution in mining finance, as firms increasingly seek to align capital structures with risk-adjusted return profiles and market cycles.

If you enjoyed this article and want to deepen your knowledge of Bitcoin mining, subscribe to our free educational newsletter. Every week, we deliver insights like these straight to your inbox to help you stay ahead and make better mining investments.