Blog • December 5, 2025 - Valentin Rousseau

Are Bitcoin Miners Accretive or Dilutive to Shareholder Value: A Study on Hashrate Funding ?

In a previous article, we discussed about the funding strategy shaped by public miners over the past years, where dilution played a prominent role to scale and hodl.

Post-2022 bear market, a dried debt capital markets and high-interest rate environment made dilution the ultimate recourse for miners. Yet one question remains: Has the bitcoin production value outpaced the cost of dilution ? To bring transparency on the capital efficiency and dilution dynamics, we derived two key metrics: the average share-price at issuance to finance the hashrate and the corresponding two-year dollar denominated bitcoin production per share.

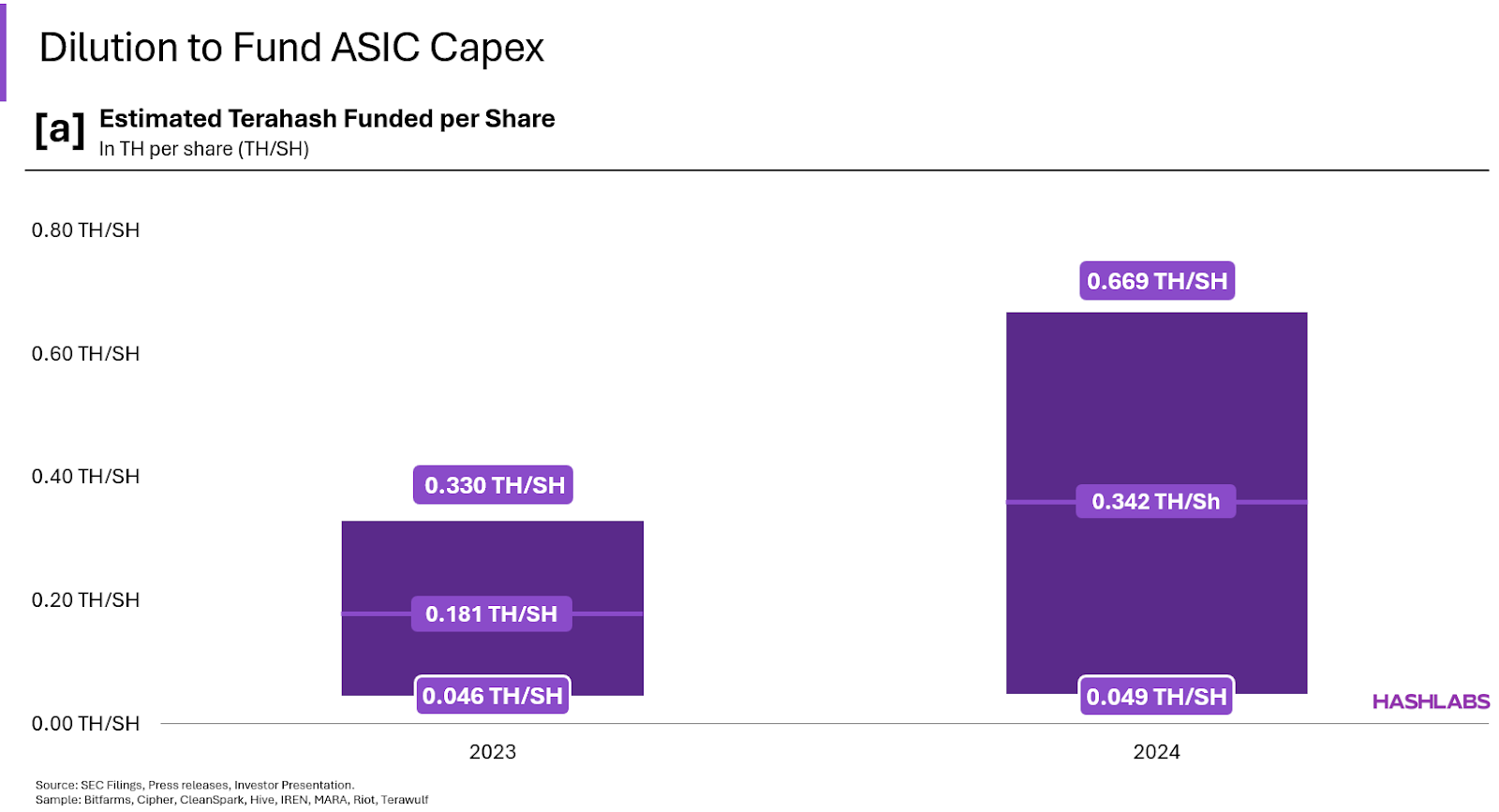

The Terahash per Share ratio (TH/SH) assesses the ability for miners to offset the cost of dilution by securing a maximum amount of hashrate as well as properly time their ASICs purchases. However, the share price discrepancy of miners might unfavorably or favorably impacts the ratio, as a higher share price should wind down the required number of shares to fund a given amount of hashrate.

Based on a sample of 8 public miners (Bitfarms, Cipher, CleanSpark, Hive, IREN, MARA, Riot, Terawulf), in 2023 miners gained on average 0.17 TH/SH against 0.35 TH/SH in 2024. Year over year, the ratio doubled because of a substantial drop in machines prices in conjunction with the resurgence of most miners’ stock prices.

Now we turn our eyes on the historical ability of miners to provide value or not to shareholders.

Importantly, bear in mind that sensitivity tables displayed are only based on a 2-year bitcoin production, whereas ASIC lifespan exceeds 3 years on mining farms which limits the scope of the study. Furthermore, note that shares issued ignore additional layers of expenses such as the SG&A which represented a daunting share of most miners revenues in 2023 and 2024.

At $100,000 bitcoin price, the 2024 bitcoin production is accretive for Bitfarms Cipher and IREN. On the reverse, the equity strategy established by CleanSpark, Hive, MARA and Riot has been dilutive on a two year basis.

Elevated accretive breakeven of CleanSpark ($127K), Hive ($106K), MARA ($129K) and Riot ($109K) indicate a weaker strategy relative to their peers, however they will become accretive at the end of the machine lifespan at a $100K Bitcoin price scenario.

From a return perspective, miners are ranging from a whopping 118.9% to a negative -22.7%. At the end of the day, the 2023 CAPEX strategy should turn positive for most of those miners based on a mean machine lifespan of 4 years, excluding the bitcoin price appreciation factor – which is only relevant for the companies holding all their production.

%20USD%20BTC%20Value%20per%20share.png)

%20USD%20BTC%20Value%20per%20share.png)

Sensitivity tables illustrate the large influence Bitcoin price has on the success of such strategy, emphasizing the implications of a BTC exposure either from a downside or an upside perspective.

Tables also reveals an interesting pattern, the larger the amount of hashrate energized, the more volatile the value generated per share becomes to fluctuations in the bitcoin price. In contrast, heavier dilution - typically resulting from a lower share price at issuance - tends to dampen this sensitivity, as the value generated per share becomes mechanically less responsive to price adjustments.

Offering a comprehensive view of shareholders return from one miners’ operation, this research strengthens the critical importance of strategy execution, particularly in securing cheap power cost and timing ASIC procurement. Thus, operational performance and historical track record must be at heart of investors due diligence before deploying capital.

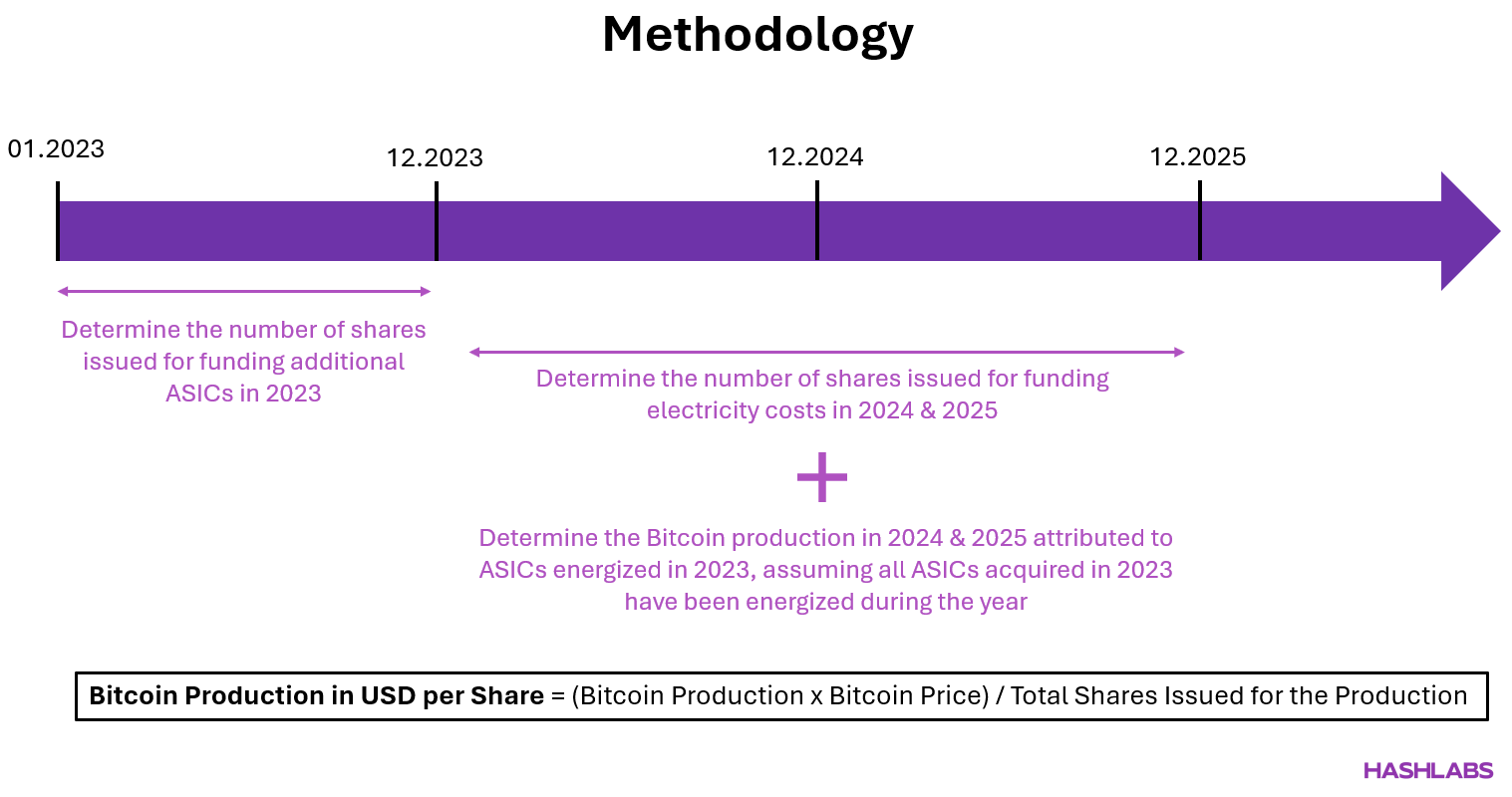

Looking at a two-year production for the hashrate acquired in 2023 effectively assumes that almost all the hashrate acquired in 2023 is effectively running early 2024 and 2025.

For simplicity, our case assumes full dilution for electricity costs to reflect a 100% holding strategy.

Finally, the PPE amount from ASICs CAPEX has been derived from SEC filings but some discrepencies might exist (especially when the breakdown of operation in the mining rigs are unavailable: such as disposals or assets transferred to held for sale – it was the case for Cipher, CleanSpark, MARA, Riot and Terawulf).

The share price used for computing the number of shares issued for direct costs and ASIC capex is an annual mean price rather than a weighted average price based on the estimated quarterly electricity and ASICs purchases as well as the quarterly mean stock price. This simplified approach might alter the results.

The Bitcoin production is only based on two years instead of the full machine lifespan. This choice has been retained due to the uncertainty regarding future stock price and hashrate movements.