Blog • November 18, 2025

Are Hosting Contracts Opaque ?

Across epochs the Bitcoin mining industry steadily gained in transparency. A momentum further accelerated by the rise of Public miners, whose monthly disclosures on operational and financial data brought unprecedented visibility.

Yet, one corner of the industry remains opaque: hosting contracts. Despite an apparent transparency on hosting benefits - tax incentives, fixed power cost, flexible revenue structure, technical expertise, high-quality infrastructure - opacity remains on actual hosting returns. All too often, profits boasted by hosting companies omit critical data and risk factors, leading to a distorted view of the actual returns investors may expect.

To bridge the gap between investors and hosting providers, this article spills the beans of hosting contracts actual returns through a detailed case study of Hashlabs’ hosting offering.

Hashlabs Case Study – General inputs and assumptions

The table below summarizes our network and operational assumptions for an “industrial-scale” hosting contract at Hashlabs:

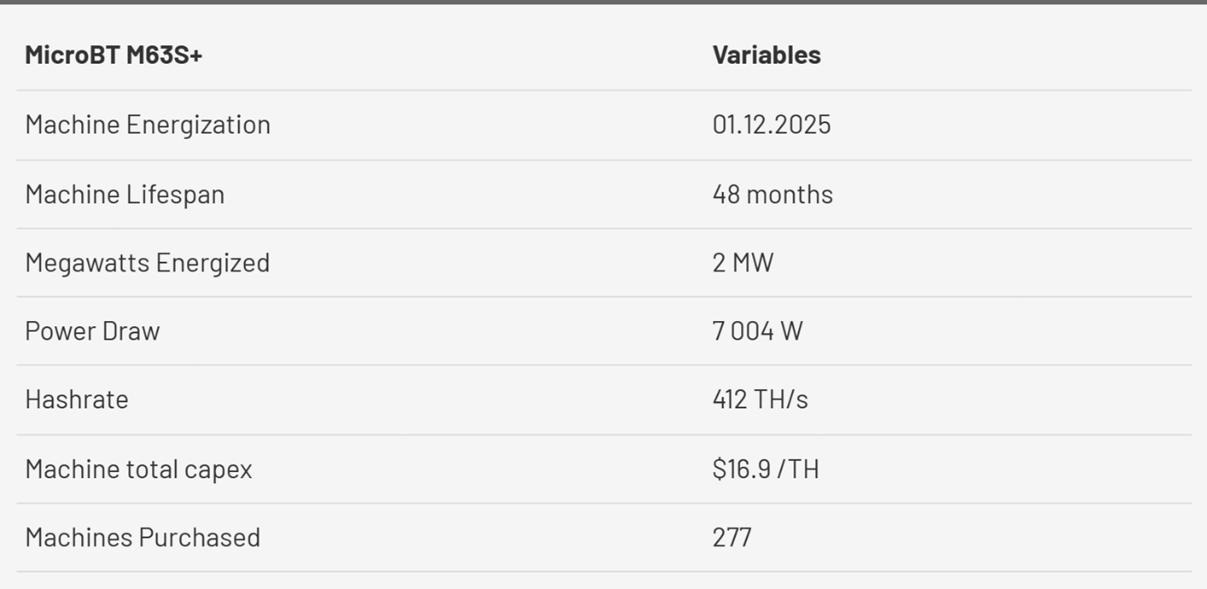

Our second data table breaks down the M63S+ specifics:

Hosting Returns Catalysts

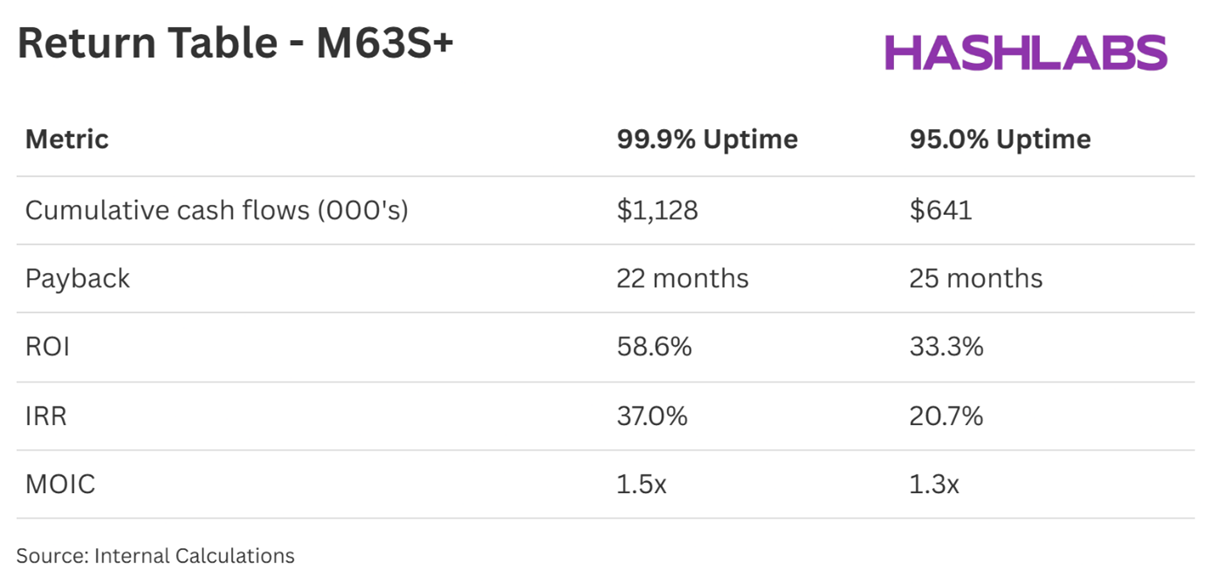

Financing a $1.9M fleet of M63S+, yields 37.0% of IRR, a ROI of 58.6% and the payback period is 22 months - ignoring any potential upside from Bitcoin (BTC) price appreciation if the net BTC mined were held in treasury.

To explore the impact from a change in key variables, we reduced the uptime at 95.0% - a level consistent with BitFuFu hosting services. While the payback period only extends by 3 months, cash flows and returns are significantly dampened by this uptime cut. Accumulated cash flows is nearly halved, ROI is falling at 33.3% (from 58.6%) and IRR at 20.7% (from 37.0%)

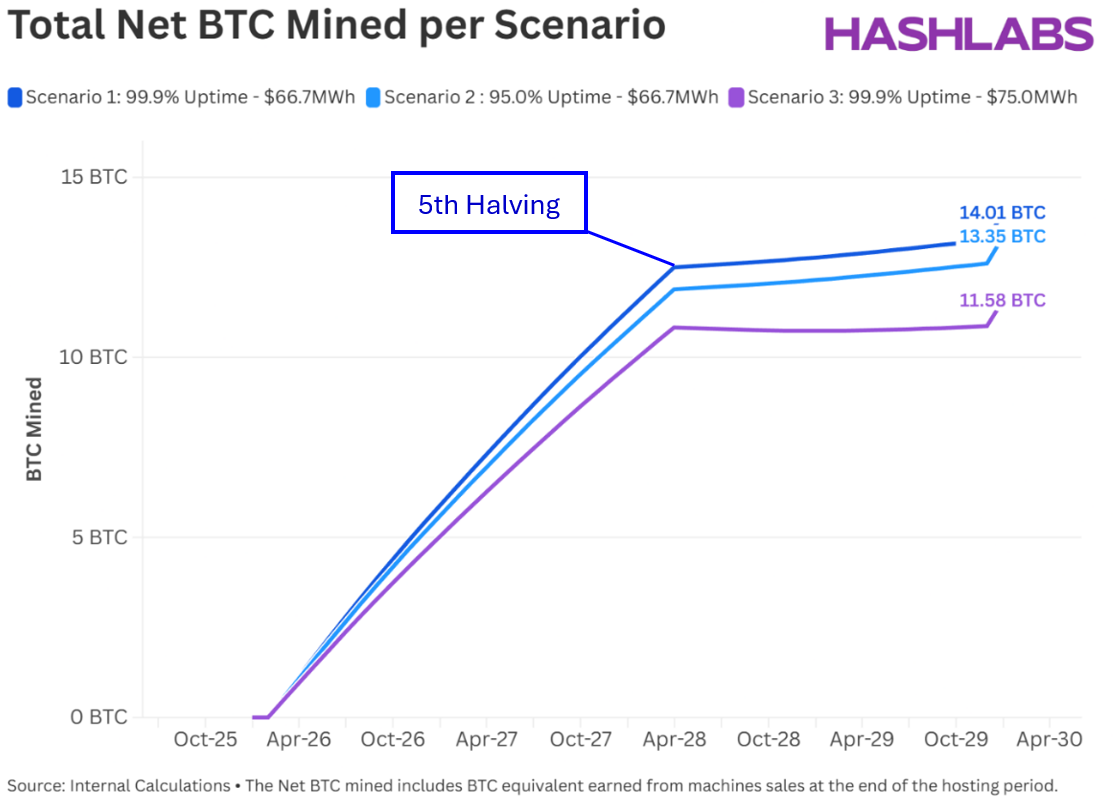

Additionally, we examined the total net BTC produced by the M63S+ fleet under three scenarios:

Net BTC produced represents the total Bitcoin mined after deducting hosting costs.

The chart reveals that the BTC production is more sensitive to hosting costs than variations in machine uptime. By mounting the power cost by 12.4% the net BTC production flipped violently to -17.3% from 14.01 to 11.58 BTC. By contrast, a -4.9 percentage point decline in uptime reduces the net BTC production by only 4.7%.

Sensitivity Tables on IRR and Total Net BTC Production

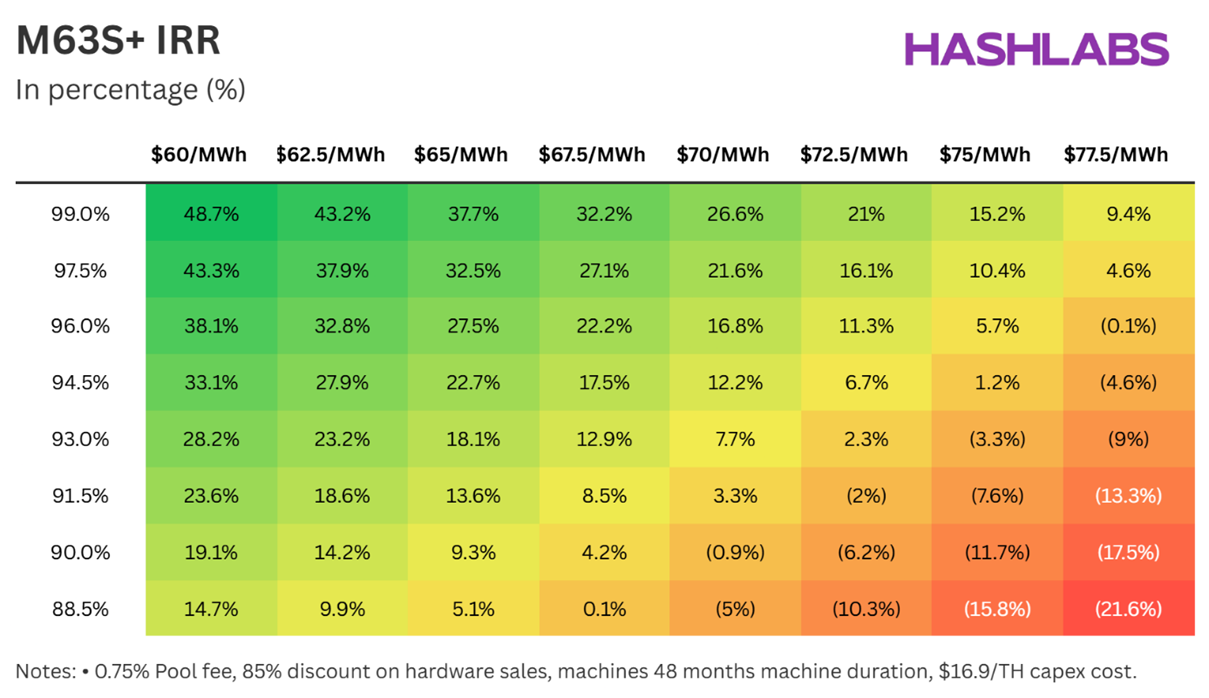

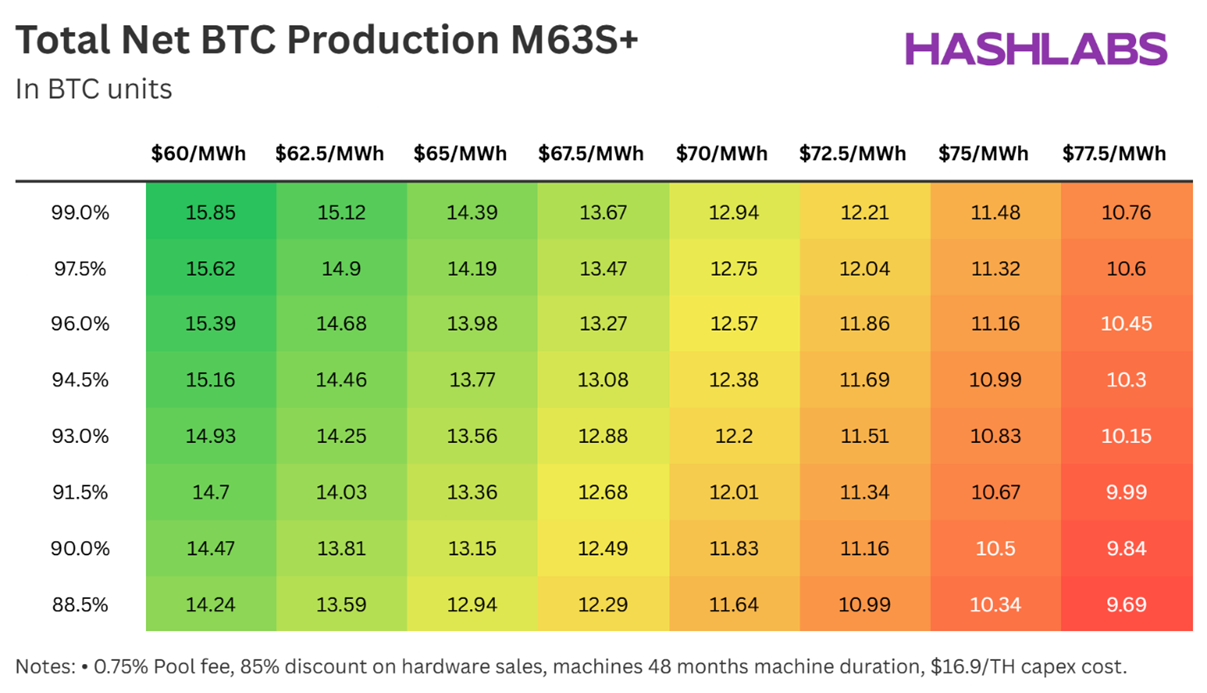

To complete the picture on returns dynamics, the tables below show estimated returns across varying levels of uptime and hosting costs.

As illustrated by this analysis, when uptime climbs from 90.0% to 99.0% at $67.5/MWh, the IRR surges by 32.1% percentage points. In the meantime, at 96.0% uptime, rising hosting prices from $65/MWh to $75.0/MWh exerts a steep pressure on the IRR, collapsing from 22.7% to 5.7%.

From the BTC Production perspective, hosting rates can materially erode returns, contrary to uptime fluctuations which is far less influential on the assessed production.

At a constant 97.5% uptime, with hosting rates soaring from $60.0/MWh to $77.5/MWh, the net BTC production tightens by 32.1%, declining from 15.62 to 10.60 BTC. In stark contrast, with fixed hosting cost at $70/MWh and an uptime uptick - mounting from 88.5% to 99.0% - the net production is only up by +11.2%.

Conclusion

Navigating through the volatility of hosting returns, this analysis unveils how critical contract terms play in determining profitability.

Hence, access to a minimum range of data is highly recommended before contracting a hosting agreement. Minimum and potential uptime fluctuations, exposure to change in power costs, among other factors, should be raised and proactively discussed in advance by investors.

Appendix

Complementary predictions on hashrate, BTC price and transaction fees.