Blog • November 21, 2025

Bitcoin transaction fees are currently at their lowest levels since 2010.

As we explained in our recent article “Don’t Forget the Transaction Fees”, this is not a temporary dip — it’s a structural shift in how Bitcoin is being used. Despite Bitcoin’s global adoption, the base chain today is remarkably calm. Transactions clear instantly for a few sats per vByte, and the mempool is often empty.

The paradox is simple: Bitcoin demand is growing, yet demand for on-chain settlement is shrinking.

This article explains why fees are so low, what has changed on the network, and what this means for miners.

Bitcoin fees are determined entirely by the supply and demand for block space. Each block is a fixed-size shipping container leaving every ten minutes. If there’s more cargo (transactions) than space available, users bid for inclusion. If there’s plenty of room, fees collapse.

Block space supply is fixed; demand fluctuates.

So even small drops in demand can produce large drops in fees — exactly what we see today.

Fees are not driven by the number of transactions, but by the value competing for block space.

A $3 Lightning coffee purchase would never hit the base chain. Meanwhile, a $10 million treasury transfer can justify paying significant fees. Therefore, the meaningful metric is total BTC volume moved on-chain, not transaction count.

As the chart above shows, daily BTC moved on-chain has stagnated and been on a slight downward trend since 2018. The wild swings of earlier cycles have disappeared, replaced by a stable level of roughly 120,000 BTC per day. Stable volume means stable — and low — fee pressure.

A second strong signal comes from active addresses.

As the chart below illustrates, before 2022, rising prices pulled more users onto the base chain. That relationship has flipped. Since 2022, the Bitcoin price has risen while active address count has fallen.

This tells us something important: Bitcoin ownership is increasing, but fewer people are interacting directly with the blockchain.

Something has changed in how users access Bitcoin. The next sections explain what.

Lightning usage has almost certainly grown. The best independent estimate (River, 2023) suggested Lightning transactions increased ~1,200% from 2021 to 2023. But Lightning payments are small, off-chain, and do not compete for block space.

People will not pay a $1 on-chain fee to buy a $3 coffee. Thus, Lightning simply enables transactions that would never have occurred on Bitcoin in the first place.

Therefore, Lightning increases Bitcoin’s utility, but it does not reduce base-chain fees.

Inscriptions and BRC-20 tokens temporarily overloaded the network in 2023–2024. They aggressively bid for block space, creating large fee spikes. But that demand was purely speculative and vanished almost overnight.

Fees fell as quickly as they rose, showing just how sensitive the fee market is to small shifts in demand.

The biggest driver of low fees is the rise of Layer-2 wrappers and custodial investment vehicles:

These vehicles give investors Bitcoin exposure without touching the blockchain. One ETF purchase by an investor does not generate an on-chain transaction. Only the ETF issuer interacts with the chain — infrequently, and in massive batched transfers.

This has transformed Bitcoin settlement.

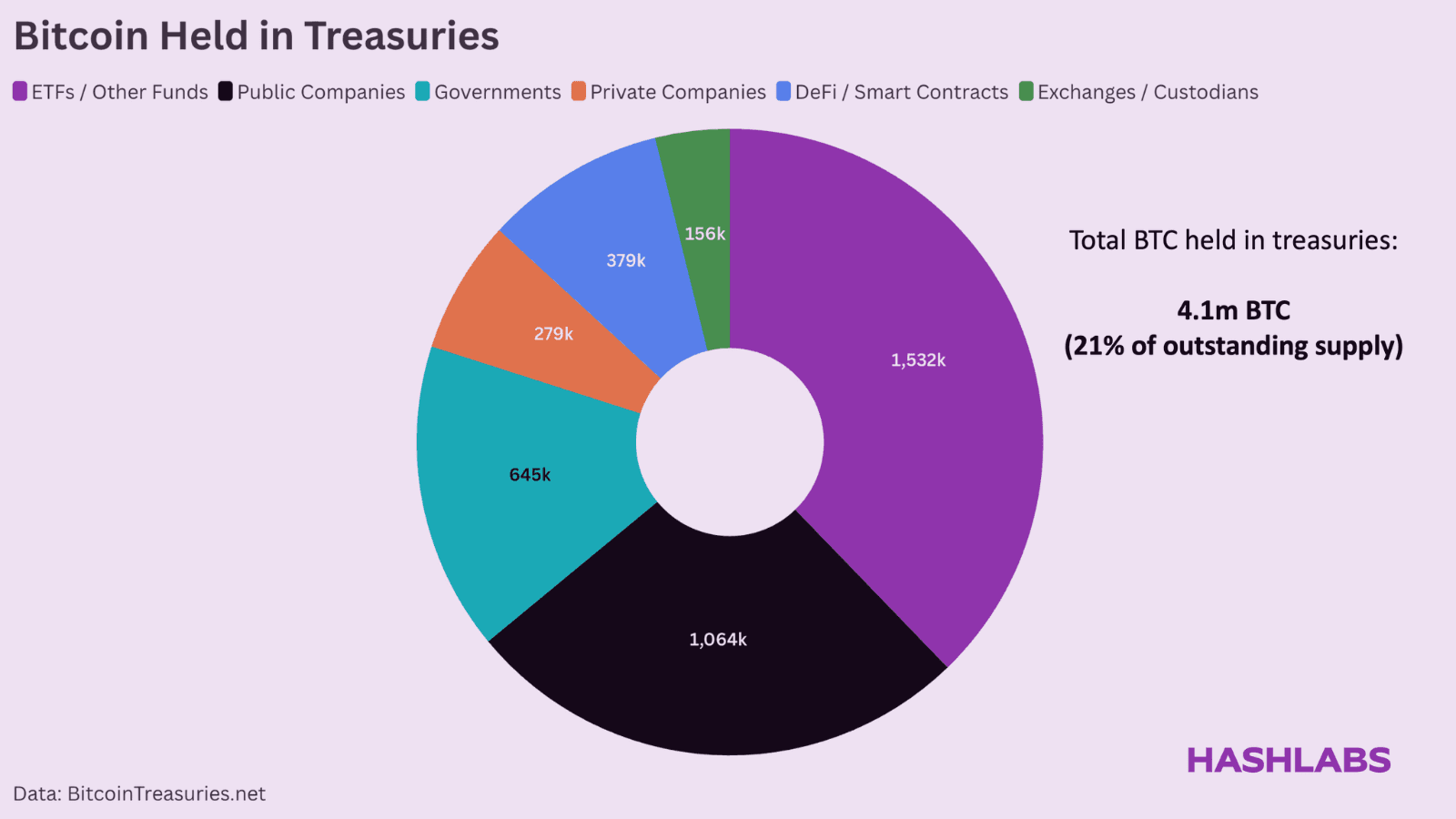

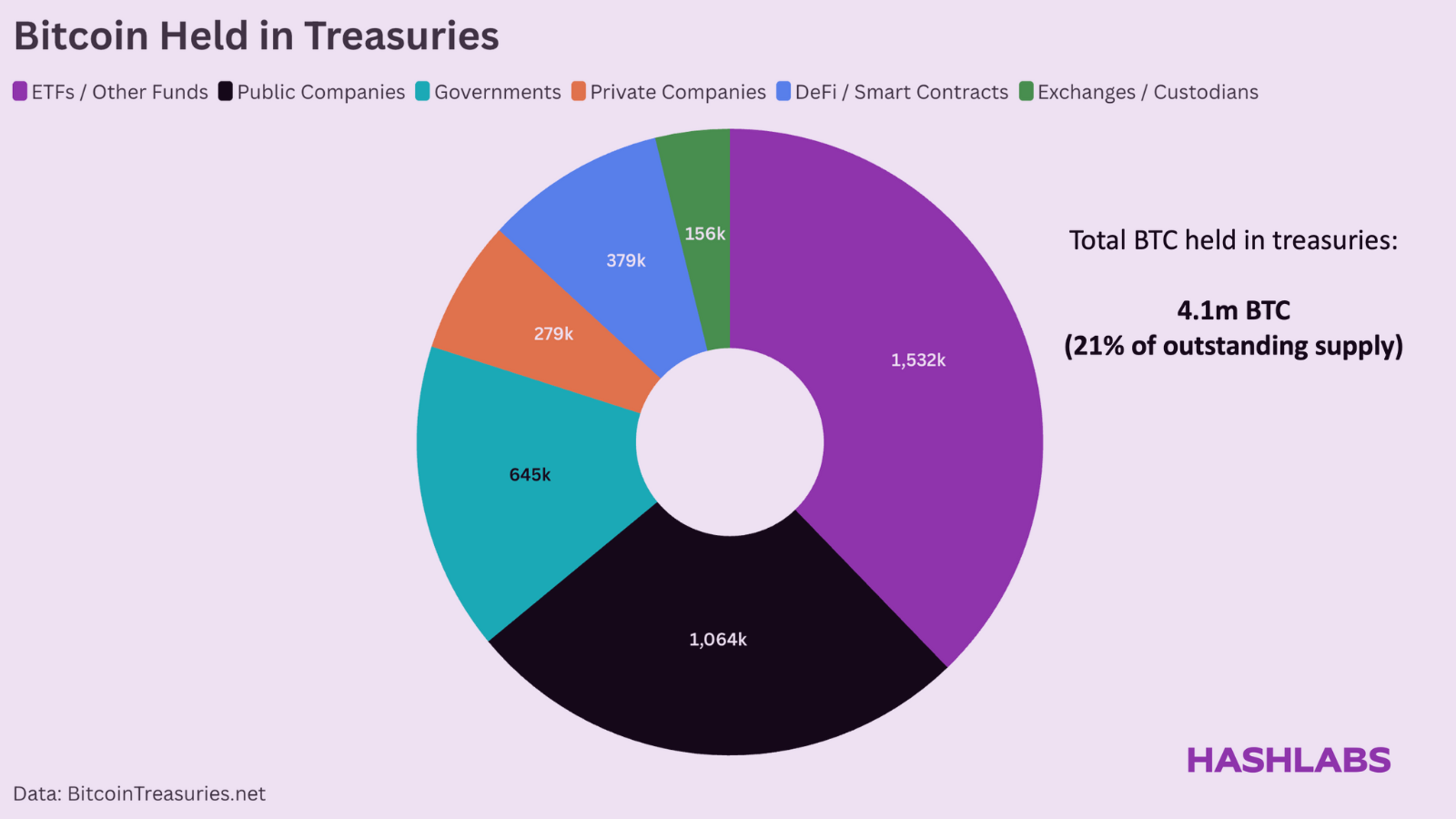

The chart above illustrates this clearly.

Today, around 4.1 million BTC — roughly 21% of supply — is held in ETFs, corporate balance sheets, and other off-chain treasuries. A few years ago, this number was close to zero.

These coins rarely move. They are professionally custodied, tightly controlled, and extremely fee-efficient. The new demand for Bitcoin is being absorbed by these structures instead of hitting the base chain.

For fees, this is devastating.

New inflows once caused mempool explosions and mania-level bidding wars. Today, they settle quietly inside ETFs and corporate ledgers. The base chain barely notices.

For miners, low fees are not a curiosity — they define the future of profitability.

Even with the current ~120,000 BTC moving on-chain per day, fee potential is limited. If users were willing to pay 0.1% of value in fees (which is generous), that would only produce ~100 BTC/day in fees. In reality, fee-to-value ratios are far lower. Actual daily fee revenue is often below 20 BTC.

As the block subsidy continues to decline, miners relying on fees alone will struggle. Mining becomes increasingly dependent on:

The winners will be miners who integrate with energy systems. The losers will be miners who rely on the fee market rescuing them.

Bitcoin fees are low because Bitcoin usage has moved off-chain.

Lightning has grown. Inscriptions have faded. ETFs and treasuries now absorb most of the investment flow that used to hit the base chain. A large share of the supply is now locked in long-term custodial structures that rarely transact.

Bitcoin is bigger than ever — but the base layer has become a calm settlement network, and calm networks produce low fees.

For miners, this shift is critical. Fees may spike during speculative episodes, but without structural blockspace demand, they will not stay high. Understanding this dynamic is essential for planning the future of mining.

If you found this useful, consider subscribing to our newsletter for more mining and energy insights.