Blog • November 18, 2025

“Why buy bitcoin for $125,000 when you can mine it for $65,000?”

That’s a common pitch — often from hosting providers selling bundled machines and hosting plans. The idea is simple and seductive: instead of buying bitcoin on the market, you can supposedly “produce” it yourself for a lower cost.

On the surface, that sounds like a smart trade. Who wouldn’t want to get Bitcoin for $65k when it’s trading at $120k? But as with most marketing shortcuts, the numbers don’t tell the whole story.

This line is built on a false comparison. It only includes the operating costs of running a miner — electricity and hosting — and completely ignores the capital cost of buying the hardware. Once you factor that in, the math unravels fast.

Let’s break down how this narrative works — and why it collapses the moment you do a proper calculation.

The so-called “$65k per BTC” figure usually includes only power or hosting costs, conveniently leaving out the hardware purchase — the single largest expense in mining.

As we explained in CapEx vs. OpEx: Understanding the Cost Structure of Bitcoin Mining, ignoring capital costs leads to a completely distorted picture of profitability.

That’s like claiming your car only costs $0.10 per kilometer because you’re only counting fuel, not the car itself. Sure, that’s your marginal cost per kilometer, but it’s nowhere near the total cost of the car.

To see just how misleading this narrative is, let’s look at a real example from another hosting provider currently promoting it.

They’re marketing the Antminer S21+ Hydro, claiming customers can “mine Bitcoin for $65k instead of buying it for the current market price ($125k)”

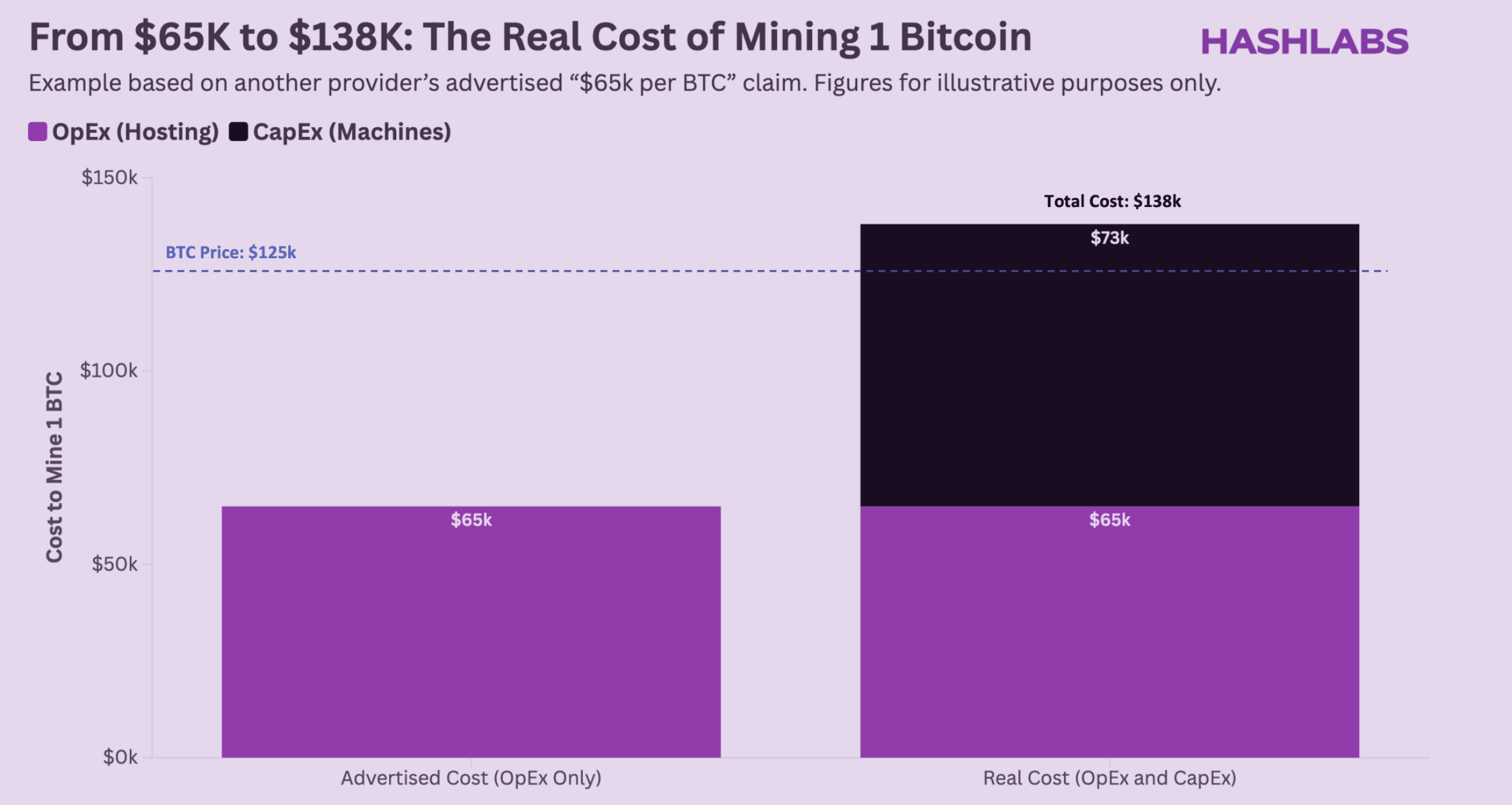

Here’s what happens when you actually run the numbers:

At this rate, the unit earns 0.0001659 BTC/day, or 0.3028 BTC over five years.

That’s extremely optimistic — difficulty will rise, halving will cut rewards, and the machine likely won’t remain profitable for five full years. Hashprice changes constantly and is the single biggest driver of mining revenue, yet it’s often ignored in these simplified claims.

So let’s be generous and halve it to 0.1514 BTC over its lifespan.

Now divide CapEx by BTC mined:

$11,000 ÷ 0.1514 = $72,648 per BTC

That’s the hardware cost per BTC mined. Add the operating cost ($65k per BTC), and your real cost becomes roughly $138k per BTC — even more than buying Bitcoin directly at $125k (!).

Even with generous assumptions, this offer doesn’t make sense — you’d likely never recover your investment. Yet, this kind of marketing persists because it preys on the illusion of “cheap Bitcoin.”

The industry deserves better.

At Hashlabs, we’ve occasionally used similar language when discussing mining costs — for example, mentioning how much it costs to produce one bitcoin under certain power rates. Technically, those numbers are correct from an operational standpoint.

However, we’ve always been clear that mining is not just about cost of production — it’s primarily about return on investment (ROI). While your operating cost determines whether you can stay online in a downturn, your ROI and overall payback determine whether the investment makes sense.

Our goal in this article is to highlight how oversimplified marketing can mislead investors when CapEx is ignored entirely.

Mining isn’t a shortcut to discounted BTC. As we’ve detailed in How to Use Payback Period to Evaluate Bitcoin Mining Returns, what really matters is how quickly you recover your investment — not just your daily operating cost.

At Hashlabs, we believe in presenting mining honestly. If someone claims you can “mine Bitcoin for $65k,” ask to see the full model — not just the power bill. You can learn more about proper evaluation frameworks in our guide, Bitcoin Mining Finance: The Best Return Metrics.

If you want more honest insights into Bitcoin mining economics, subscribe to our newsletter — we cut through the noise with real data and clear analysis.