.png&w=3840&q=75)

Blog • November 18, 2025

Lately, some US hosting providers have been pushing Bitcoin mining as a clever way to “save on taxes.” You’ll see posts with a tone like:

“You can write off your entire mining machine in the first year. You’ll save so much on taxes, bro. Just buy a machine from us, bro.”

It sounds great—mine bitcoin and save thousands in taxes.

But that’s not how taxes actually work. What they’re referring to is bonus depreciation — taking the full depreciation for qualifying equipment in Year 1 instead of spreading it over time. That doesn’t reduce your total taxes; it only shifts when you take the deduction. The true benefit is a small time-value effect — not a big tax windfall.

We’ll prove it with the very machine they’re hyping: an overpriced Antminer S21 Pro+ Hydro at $11,000 — though for simplicity, let’s round it down to $10,000.

Let’s unpack what “bonus depreciation” actually means and why it’s so often misunderstood.

Under normal IRS rules, computer equipment — which includes bitcoin mining machines — is depreciated over three years. That’s consistent with both IRS guidelines and industry practice among public miners.

With bonus depreciation, you can deduct the entire cost of the machine in the first year instead of spreading it across three.

So yes, you can “write it all off” in Year 1. But that’s not a direct tax saving — it’s just a timing difference.

If your effective tax rate is 30%, then the $10,000 deduction gives you a temporary deferral of $3,000. The total tax deduction remains the same; you’re simply taking it now instead of over three years.

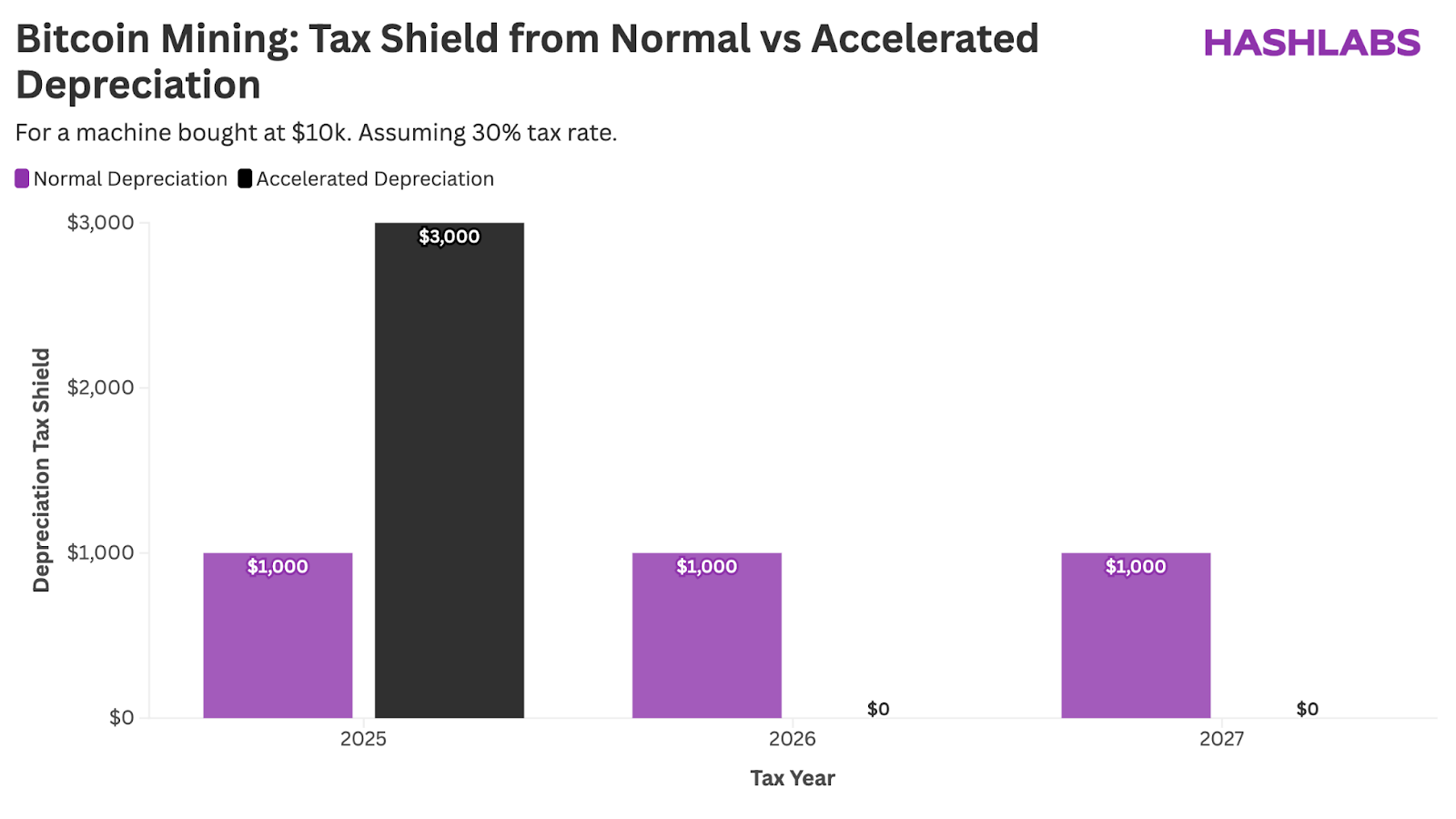

To visualize this, let’s compare the normal three-year schedule with bonus depreciation side by side.

In the chart, the purple bars show the tax deduction under normal depreciation — $1,000 per year. The black bar shows bonus depreciation — a single $3,000 deduction in Year 1 and nothing thereafter.

The total deduction over time is identical ($3,000). Bonus depreciation simply moves it all into Year 1, giving you a lower tax bill now but higher taxable income later.

It’s a timing shift, not a tax saving.

Of course, the timing shift has an economic value, according to the time value of money principle. But as we will explain in the next section, this economic value is very small compared to the implied tax savings advertised by the US hosting provider.

Some hosting bros make it sound like you’re “saving thousands” in taxes.

In reality, the only benefit comes from the time value of money — the slight advantage of taking a deduction earlier.

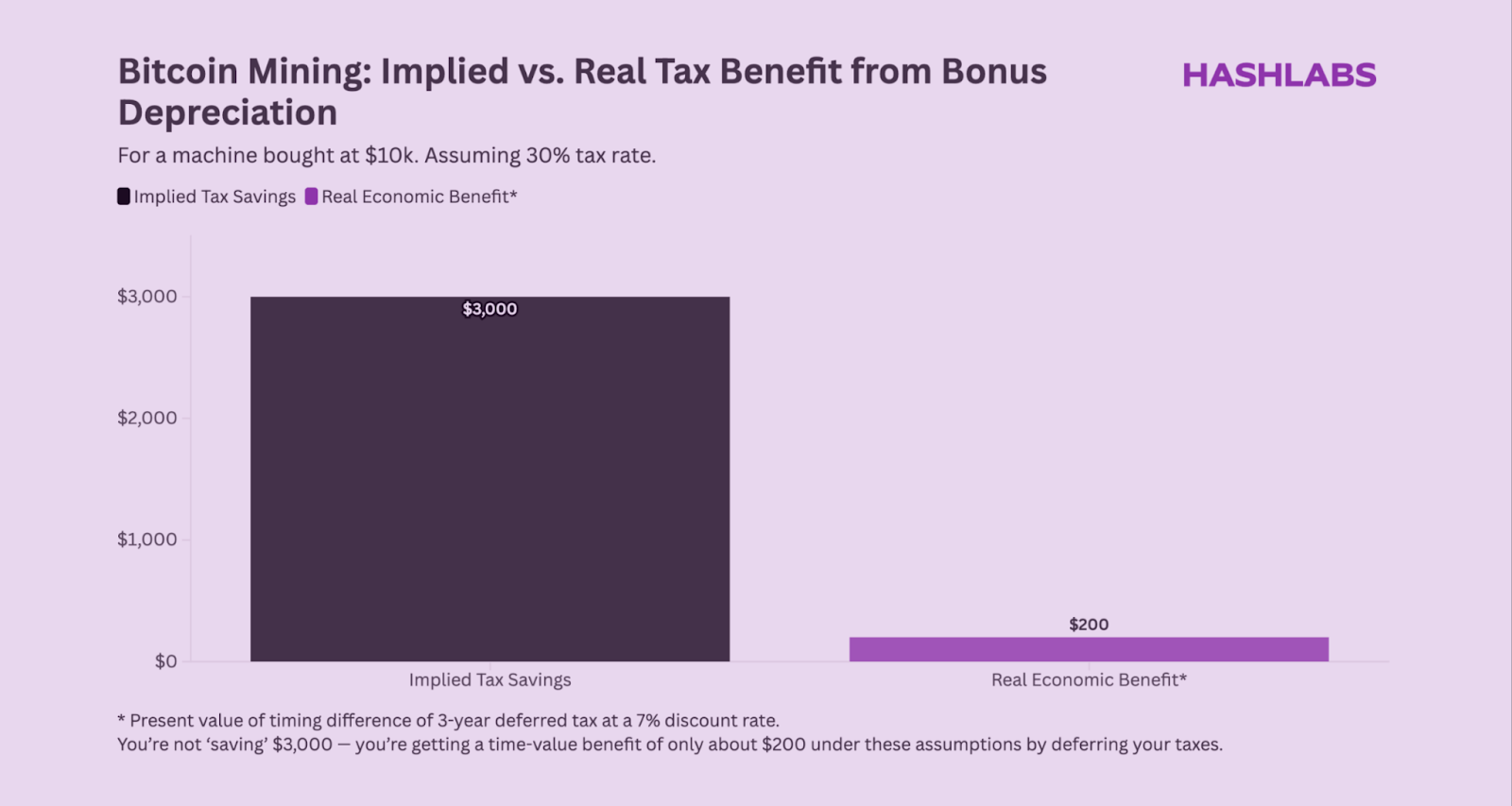

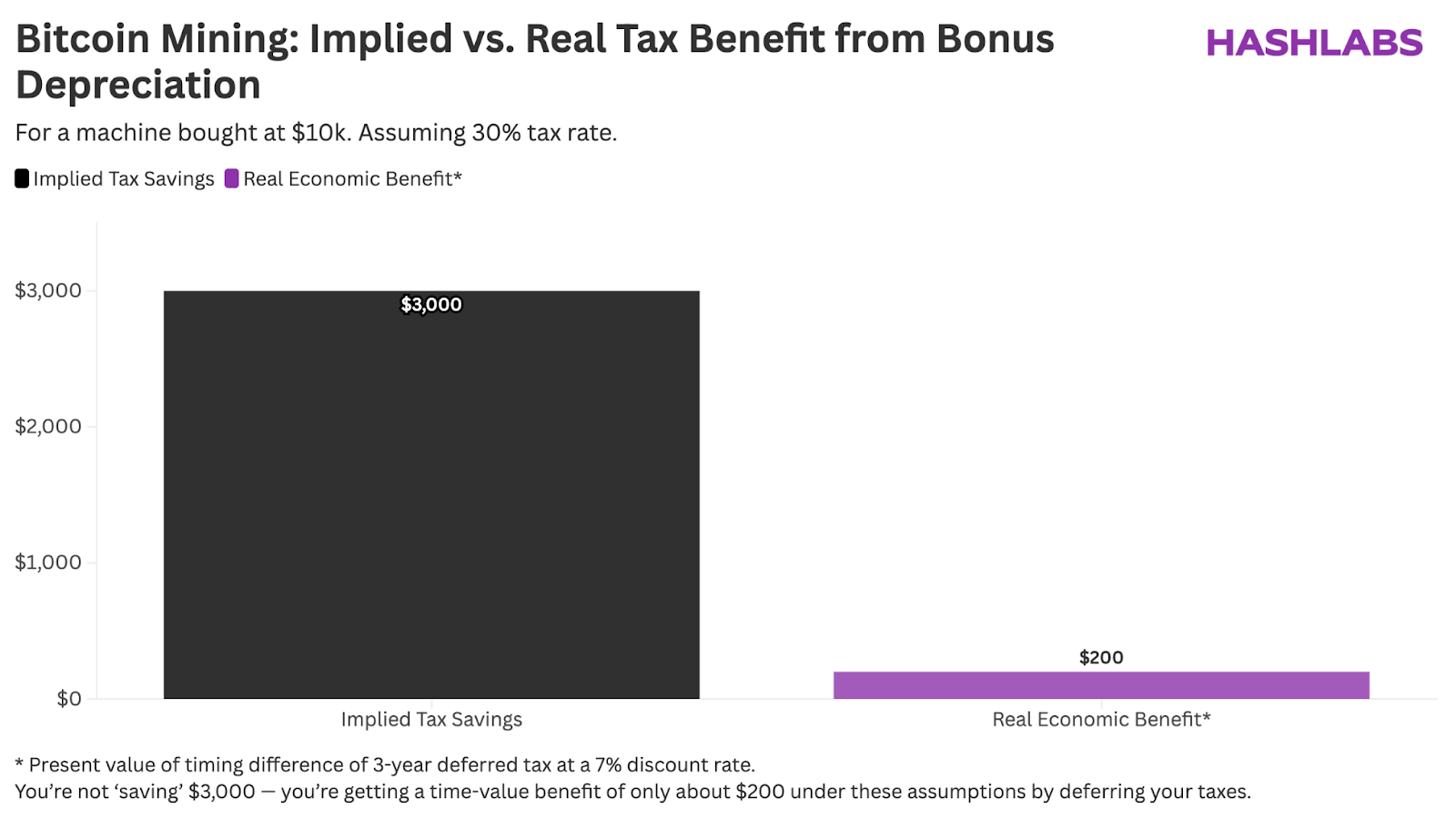

This chart compares the implied benefit of $3,000 (30 % × $10,000) with the real economic benefit of roughly $200 once you account for time value at a 7 % interest rate.

The difference is striking: the “tax saving” is an illusion created by timing. You’re not pocketing $3,000 — you’re just deferring part of your tax bill for a short period, worth only a couple hundred bucks.

As we have explained, bonus depreciation doesn’t reduce total taxes. Furthermore, it doesn’t change the fact that mining is a taxable business.

When you mine bitcoin, you generate taxable income at the market value of the bitcoin you earn after costs.

If you simply buy bitcoin, you owe no income tax until you sell — only capital gains tax on appreciation.

So while bonus depreciation gives a minor short-term timing benefit, mining itself increases your annual taxable income.

Of course, that’s not necessarily bad — if you don’t overpay for machines and operate efficiently, mining can be profitable.

But if you’re paying overpriced hosting rates and above-market machine prices, even the small timing benefit from bonus depreciation gets wiped out immediately.

For example, the same hosting bros currently selling S21 Pro+ Hydros for $11,000 also like to promote the idea that this machine can “mine a Bitcoin for $65,000.”

We’ve already debunked that claim in The $65K Bitcoin Mining Myth — and Why It Doesn’t Add Up.

It’s true that you can deduct hosting, electricity, and maintenance costs — but that’s not a mining-specific tax advantage.

Every normal business deducts its operating expenses:

That’s standard accounting, not a “tax play.”

So when hosting bros emphasize that you can “write off your hosting and machines,” they’re just describing routine business deductions — not a unique benefit.

The idea that mining dramatically reduces your tax bill is a marketing narrative, not a fact supported by math.

Bitcoin mining can be a solid business for those who operate wisely — but it’s not a tax strategy.

And honestly, it’s a bit ironic that we’re not even a U.S. company, yet we seem to understand the U.S. tax system better than some of the hosting bros over there implying these “advantages.”

If you found this article interesting, subscribe to our newsletter below and check out our other articles on the Hashlabs Blog.