Blog • November 18, 2025

Buying a Bitcoin miner outright means committing significant capital upfront. To lower that barrier, some miners turn to leasing — a structure that spreads hardware costs over time while changing how you evaluate ROI, risk, and flexibility.

This article explains how Bitcoin miner leasing works, how it differs from buying, and when it might make sense. We’ll also use the Hashlabs Lease-to-Mine program as a case study.

Leasing a Bitcoin miner works much like leasing industrial equipment — a standard practice across manufacturing, logistics, and data centers.

It benefits both sides:

In mining, the lessee leases machines from the lessor — here, Hashlabs — and earns BTC while making fixed monthly leasing payments. Ownership usually stays with the lessor, though some leases include a buyout or transfer option.

Leasing converts a one-time CapEx into predictable OpEx, lowering entry cost but adding financing obligations.

For a deeper breakdown of costs in bitcoin mining, see CapEx vs. OpEx: Understanding the Cost Structure of Bitcoin Mining.

Mining combines high capital intensity with volatile revenue. Machine prices move fast, difficulty grows, and bitcoin’s price fluctuates. Leasing helps miners manage this risk by reducing upfront exposure and preserving liquidity.

The trade-off is simple: lower entry cost and flexibility versus higher total cost over time.

To assess this balance, use financial metrics like IRR and payback — covered in Bitcoin Mining Finance: The Best Return Metrics.

As an example, here’s how Hashlabs structures a fair lease:

At a purchase price of $6,452, this implies an effective financing rate near 10%, comparable to standard industrial equipment leasing. See full program details.

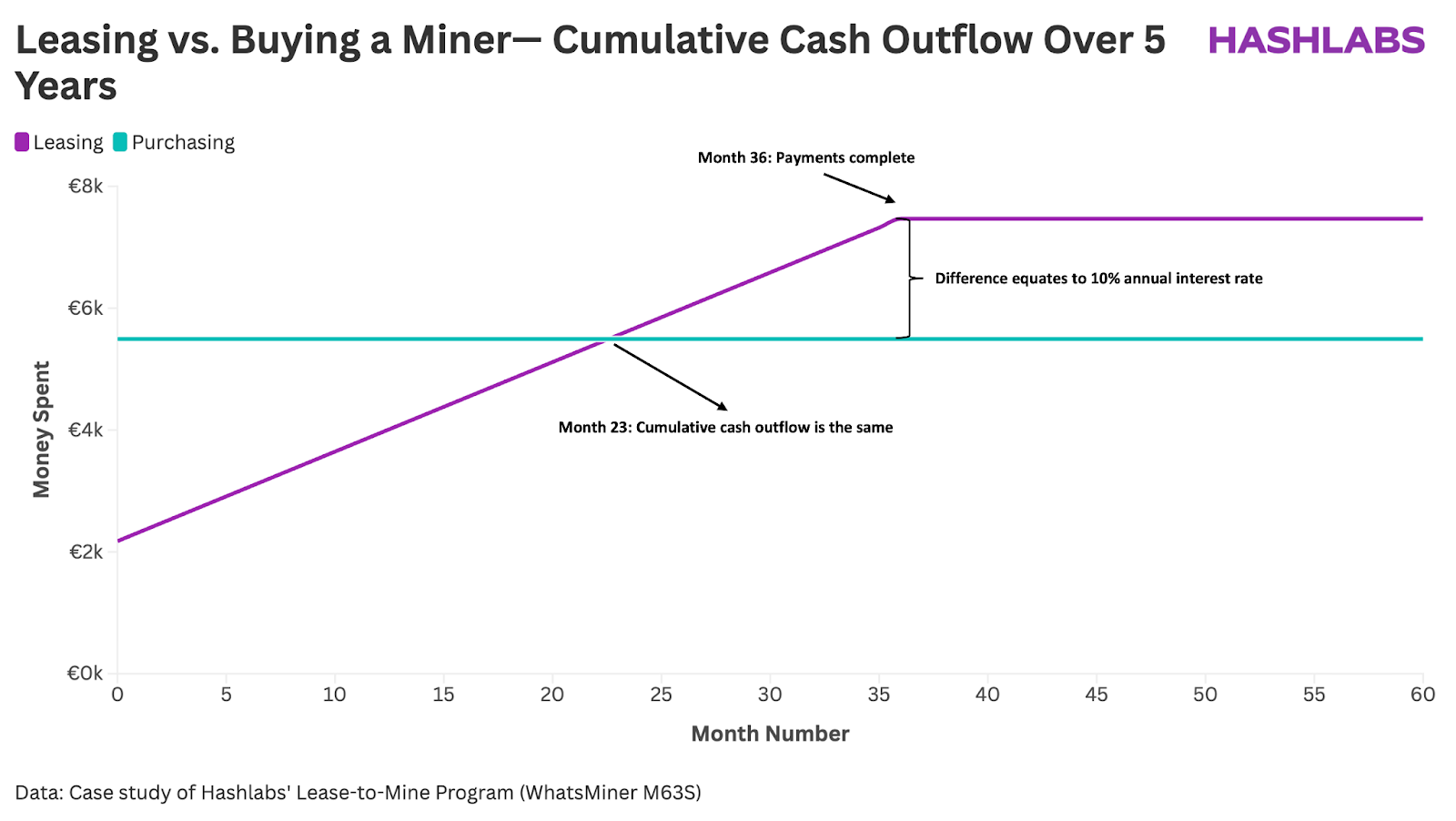

While the table summarizes the structural differences, it doesn’t show how cash outflows evolve over time.

The chart below compares cumulative cash spent under both approaches over a 5-year period — highlighting how leasing spreads costs gradually, while buying concentrates them upfront.

As the visualization shows, buying a miner demands substantial capital at the start — creating a steep initial spike — while leasing flattens that curve.

This difference in timing is key: leasing improves liquidity and capital efficiency, even if total cost ends up slightly higher. For many operators, that flexibility can outweigh the financing premium.

Leasing suits miners who:

Since the lessor retains ownership, the lessee typically books only lease payments as operating expenses — avoiding complex depreciation and asset tracking. This simplifies accounting and tax reporting, especially for firms with multiple sites or investors.

Buying is better if you have cheap capital, seek full control, or plan to operate long-term.

In short: leasing favors efficiency and simplicity, while buying maximizes ownership and upside.

1. Effective interest rate

Compare total leasing cost to buying. You can estimate the implied rate in Excel or ask ChatGPT with all inputs.

2. Term vs. hardware lifespan

Ideally, the lease should run close to the machine’s useful life — letting you mine until it’s fully depreciated. This makes leasing similar to buying with financing.

See How to Use Payback Period to Evaluate Bitcoin Mining Returns for how to model this.

3. Difficulty and halving

Ensure your expected monthly profit covers the lease payment. If network difficulty rises faster than expected, you may need to supplement payments from your own funds.

4. End-of-term ownership

Some leases transfer ownership automatically, others don’t. On 5-year leases (like Hashlabs’), this matters less since resale value is minimal by then.

5. Exit options

Transparent leases let you exit early if mining becomes unprofitable, though you forfeit use of the equipment.

Leasing shifts payment timing — not mining fundamentals. Both buyers and lessees face pressure in weak markets; the difference is whether losses are front-loaded or spread out.

Leasing Bitcoin miners isn’t a shortcut to “cheap Bitcoin” — it’s a financing mechanism that changes how you allocate capital and manage risk.

Hashlabs’ Lease-to-Mine program is one example of a transparent structure, where the lessor finances and owns the hardware while the lessee operates it, earns BTC, and pays a clearly defined financing rate.

If you’re exploring how leasing could fit into your mining strategy — or want to model your potential returns — feel free to contact us for a detailed walkthrough.