Blog • November 17, 2025

Imagine you’re running a small business, pouring every dime into a single product, say, artisanal coffee. It’s a hit when the market’s hot, but then supply chains wobble, costs spike, and a new café opens next door with fancier lattes. Suddenly, your margins are razor-thin, and you’re wondering if you can keep the lights on. That’s the gut punch Bitcoin miners are feeling right now. The crypto gold rush, once a sure bet for those with the right gear and cheap power, is hitting a wall. With Bitcoin’s network hash rate soaring past 900 exahashes per second (EH/s) and the 2024 halving slashing block rewards to 3.125 BTC, the math is getting ugly. But here’s the twist: These same miners, sitting on massive power plants and high-tech rigs, are finding a lifeline in an unlikely place, AI data centers. Welcome to the pivot that could redefine an industry.

This isn’t just a crypto nerd’s pivot, it’s a survival story that anyone who’s ever bet on a risky venture can relate to. Bitcoin mining companies like Core Scientific, Iris Energy, and Bitfarms aren’t abandoning their roots; they’re doubling down on their biggest asset: infrastructure that’s practically tailor-made for the AI boom. Think of their sprawling facilities, humming with electricity, cooled like a sci-fi server room, and wired for speed, as the perfect Airbnb for AI’s compute-hungry tenants. In this first part of my series, I’ll unpack why miners are making this leap, how their setups make it possible, and what’s at stake for their future. Spoiler: It’s less about chasing trends and more about staying afloat in a world where AI is the new gold rush.

Let’s break it down like you’re explaining it to a friend over coffee. Bitcoin mining is like running a giant lottery: You invest in powerful computers (ASICs) to solve math puzzles, win Bitcoin, and hope the price stays high enough to cover your electric bill. But every four years, the Bitcoin halving cuts your winnings in half, think of it as your boss slashing your paycheck while expecting you to work harder. The 2024 halving dropped rewards to 3.125 BTC per block, and with global hash rates (the total computing power chasing those coins) at 900-1,000 EH/s, it’s a crowded race. As some analyst have put it: “It’s a real challenge... you don’t know what the price of Bitcoin is going to be, and you can’t guarantee what the energy cost is.” Sound familiar? It’s the kind of uncertainty that keeps any entrepreneur up at night.

Now, let’s talk numbers, because they tell the story. A single megawatt (MW) of mining capacity today, running efficient rigs at ~20 joules per terahash (J/TH), might earn you $896,000 a year with Bitcoin at ~$100,000. Not bad, right? But here’s the kicker: Pivot that same MW to High-Performance Computing (HPC) for AI workloads, and you could pull in $1.46 million annually, locked in through long-term deals. That’s straight from Risk On Investor’s June 2024 analysis, which breaks down Core Scientific’s $3.5 billion, 12-year contract with CoreWeave for 200MW. That’s a 60% revenue boost, with no guessing about Bitcoin’s next price swing or whether your power bill will spike thanks to a geopolitical flare-up (looking at you, global energy markets).

So, why are miners so well-positioned to jump into AI? It’s not just about chasing a hot trend, it’s about what they already have. Bitcoin mining farms are like the industrial kitchens of the crypto world as they are built for high heat, big power, and constant uptime. They’ve got MW-scale electricity grids (often in cheap-energy spots like Texas, Pennsylvania or mostly in countries of Africa), advanced cooling to keep rigs from melting, and fiber-optic connections for lightning-fast data. Swap out some ASICs for GPUs, and you’ve got a data center ready for AI training, think ChatGPT-level workloads or Nvidia’s latest neural nets.

Take Hive Digital, for example, look at Iris Energy’s Childress, Texas site, its dense, energy-optimized design is practically begging for AI tenants. The overlap is almost poetic: Both mining and AI need reliable power (miners control ~4GW today, per Avory & Co.), compute density, and low latency. The U.S. needs 30GW for AI by 2030 but only has 4GW now. Guess who’s got the keys to bridge that gap? Miners.

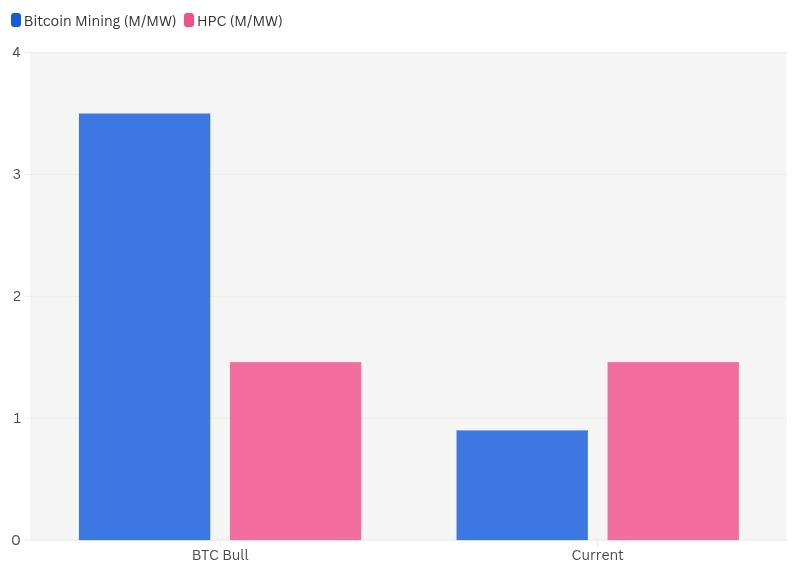

To see why this pivot makes sense, check out this chart built below using data from Risk On Investor’s revenue breakdowns and Avory & Co.’s hash rate projections:

Source: data from Risk On Investor’s revenue breakdowns and Avory & Co.’s hash rate projections

Here’s the deal: Two scenarios, side by side. In “Current” (2025, BTC at $100K, 900 EH/s), HPC’s pink bar towers over mining’s blue, $1.46M/MW vs. $0.9M/MW. In a “BTC Bull” case (say, $200K), mining flips to $3.5M/MW, but HPC stays steady. Sourced from Risk On Investor’s CoreWeave deal analysis and Avory & Co.’s efficiency models, this visual screams one thing: HPC is your safety net.

Before you think this is a slam dunk, let’s keep it real. Retrofitting a mining site for AI isn’t cheap, $5-7M per MW, compared to mining’s $400K/MW setup. That’s a big check for companies. Plus, miners are crypto wizards, not AI gurus, there’s a learning curve. And those juicy HPC contracts? They lock you in for 10-12 years, meaning you miss out if Bitcoin hits $200K. As Anthony Power says in Avory & Co., “HPC will give them a baseline of solid recurring revenue which they don’t get with Bitcoin.” For a sector battered by two rough years (even with BTC’s $42K-to-$120K rally), that stability is a lifeline.

This is just the start. Miners aren’t just hedging bets, they’re rewriting their playbook. In Part 2, we’ll dive into the deals lighting up the space: Bitfarms’ all-in AI pivot, Bitdeer’s chip innovations, and Cipher’s $3B Google-backed play. Want to know who’s winning and who’s just hyping? Subscribe to our news letter, and keep coming back to read more articles.