Bitcoin mining can be highly profitable — but only for those who make disciplined, data-driven decisions. Many miners rush into buying machines based on hype or sales pitches instead of proper analysis.

To help miners make smarter decisions, we’ve developed a simple four-step educational framework that ties together everything you need to know — from understanding the basics to choosing the right hosting provider.

Disclaimer: This article is for informational and educational purposes only and does not constitute financial, investment, or tax advice. Bitcoin mining involves substantial risk, and readers should conduct their own research or consult qualified professionals before making investment decisions.

Before investing, take the time to understand what drives mining profitability — bitcoin price, network difficulty, machine efficiency, and electricity cost — as well as the main risks, such as market volatility, downtime, or simply getting rug pulled by a bad hosting provider.

Start by reading the educational resources on the Hashlabs blog and subscribe to the Hashlabs newsletter for ongoing insights. The time spent learning the basics will save you from costly mistakes and poor decisions.

As good old Warren Buffett says, every investor should stay within their circle of competence. If mining isn’t yet part of yours, study the industry before committing large amounts of capital. Of course, starting small can be smart — you’ll learn much faster once you have some skin in the game. But don’t bet your house on something you don’t yet fully understand.

Once you understand the fundamentals, study the market and timing.

Bitcoin mining is a hyper cyclical industry — profits and machine prices surge in bull markets and compress in bear markets. The best opportunities often come when nobody is talking about mining. As Buffett famously said, “Be fearful when others are greedy, and greedy when others are fearful.”

That means buying machines when sentiment is negative and prices are low, not when everyone else is piling in during a bull run. Occasionally, it can still make sense to buy during bullish periods if machine prices lag behind bitcoin’s price rise — but in general, superior returns come from being early, not from following the crowd.

When researching opportunities:

This part of the framework is also the most difficult. Understanding the true state of the market requires experience — it’s more of an art than a science. That’s why we’re not prescribing any specific tools or models here. Instead, learn to develop your own judgment over time. Trust your intuition — and as a general rule of thumb, if nobody else is looking to invest in mining, that might be the right time to start.

Once you find a potential acquisition or hosting deal, evaluate it using just two metrics — and ignore everything else.

Use the payback period to measure how quickly you’ll recoup your investment — it’s your pure return metric. Then, supplement it with the cost-to-revenue ratio, which shows how much profit margin your machines are generating. This second metric reveals how close you are to becoming cash flow negative — in other words, how far you are from being forced to turn your machines off.

These two numbers tell you all you need to know about profitability and risk. Ignore any talk about “ancillary benefits” like non-KYC bitcoin or tax advantages — especially from the hosting bros trying to sell you machines or hosting.

As we explained in No, Mining Does Not Reduce Your Taxes, such claims are misleading and often used to disguise poor economics.

Focus on the math — not the marketing.

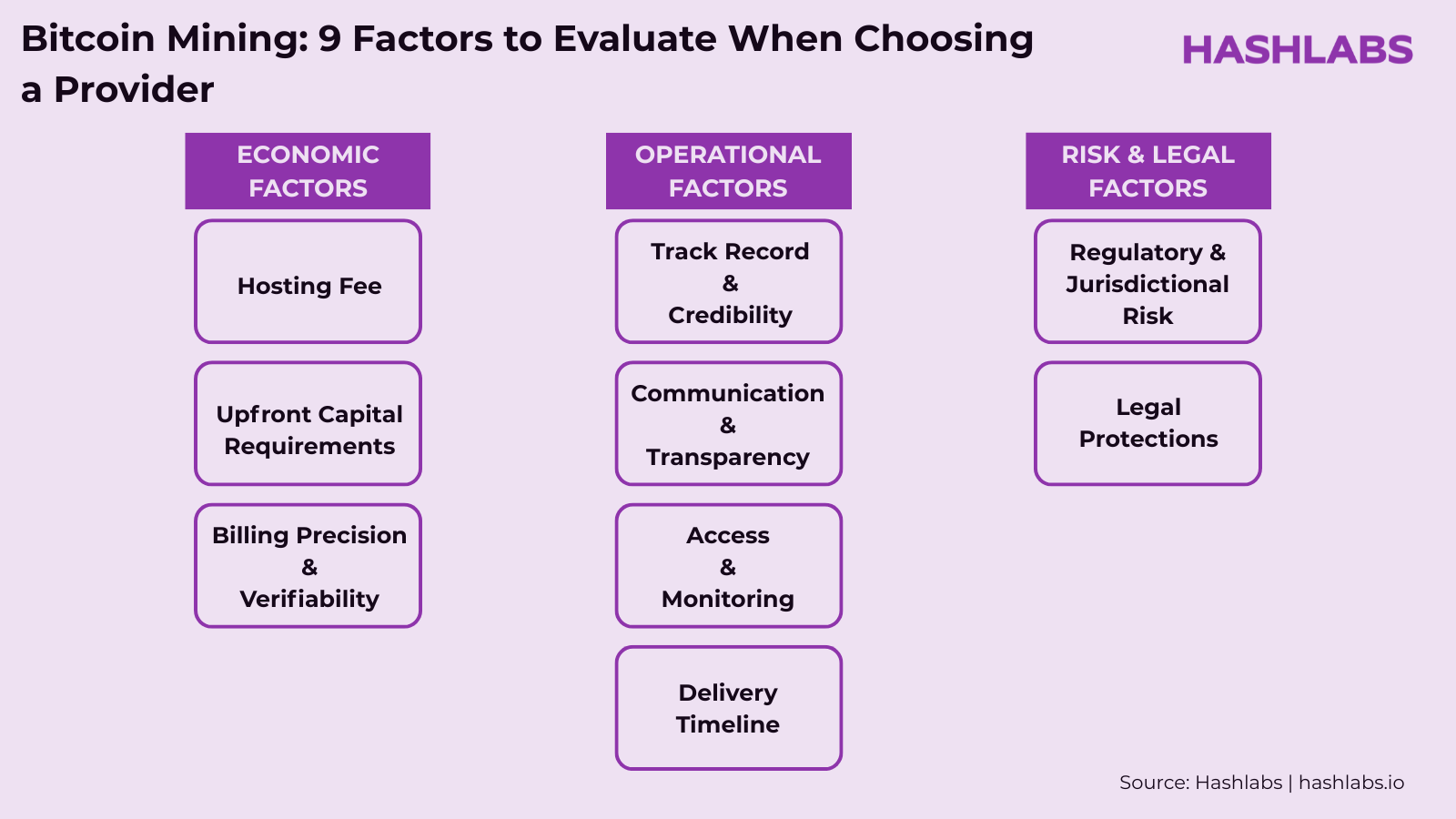

Even the best numbers can collapse if your hosting provider underperforms. Uptime, transparency, and integrity determine whether your mining operation succeeds.

Use our guide — 9 Factors to Evaluate When Choosing a Provider — to assess partners carefully.

Profitable bitcoin mining requires process and discipline, not luck or marketing hype.

Follow these four steps to make smarter, data-driven decisions:

If you want to become a smarter and more profitable miner, subscribe to the Hashlabs newsletter to receive expert analysis, educational resources, and industry updates directly to your inbox.